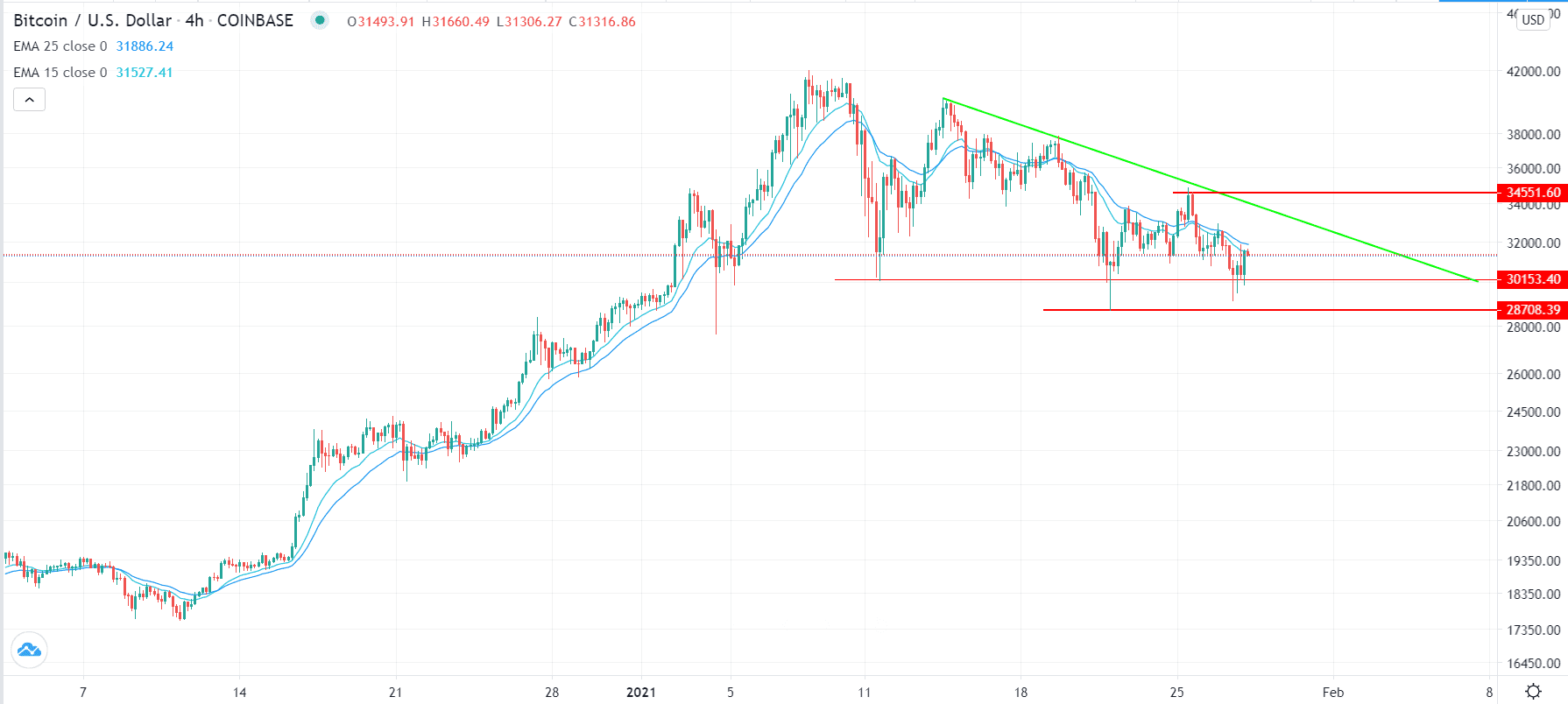

Bearish case

Short the BTC/USD and set a take-profit at 28,708 (22 Jan low).

Set a stop-loss at 34,500

Bullish case

Set a buy stop at 34,500 and a take-profit at 36,000.

Add a stop-loss at 30,153.

Bitcoin price bounced back in the overnight session after it dropped below the $30,000 mark yesterday. The BTC/USD is up by more than 3% and is trading at $31,465. Other cryptocurrencies like ETH, LTC, and BCH have also bounced back, bringing their total market cap at more than $929 billion.

Institutional Demand Fading

The BTC/USD has been under pressure this month after it rose to an all-time high of more than $41,000. The pair has fallen by more than 25% from its all-time high.

There are several reasons for this weakness. First, it is probably because of profit-taking after the digital currency rallied by more than 50% in the first few days of the year.

Second, analysts believe that there will be stricter regulations of digital currencies during the Joe Biden administration. In her confirmation hearing, Treasury Secretary, Janet Yellen said that the government needs to issue more regulations to curtail the illegal activities. She cited the role of cryptocurrencies in funding crime.

Experts believe that the government has several options. For example, it could put more regulations to curtail cryptocurrencies wallets. Also, the government could put more pressure on companies that accept digital currencies like Bitcoin.

Third, the Bitcoin price has dropped because of the rumours that the SEC will accept a Bitcoin Exchange-Traded Fund (ETF). In the short-term, this is bearish for BTC because it would incentivise more investors to dump the expensive Greyscale Bitcoin Trust and shift their resources to the ETF.

Finally, the BTC/USD has dropped because of signs that institutional demand was waning. In a report earlier this week, analysts at JP Morgan said that inflows into Bitcoin funds had started to wane. In a similar report yesterday, those at Guggenheim Partners said that there was no demand so long as the price is above $30,000.

BTC/USD Technical Outlook

On the four-hour chart, we see that the Bitcoin price dropped to below $30,000 where it found a strong support. The currency has also formed a strong descending triangle pattern and is below the 25-day moving average.

Therefore, the pair will likely continue falling, with the next level to watch being $28,700. The stop-loss for this trend is at $34,500, which is at the intersection of the descending trendline and the highest point on January 25.