Bullish case

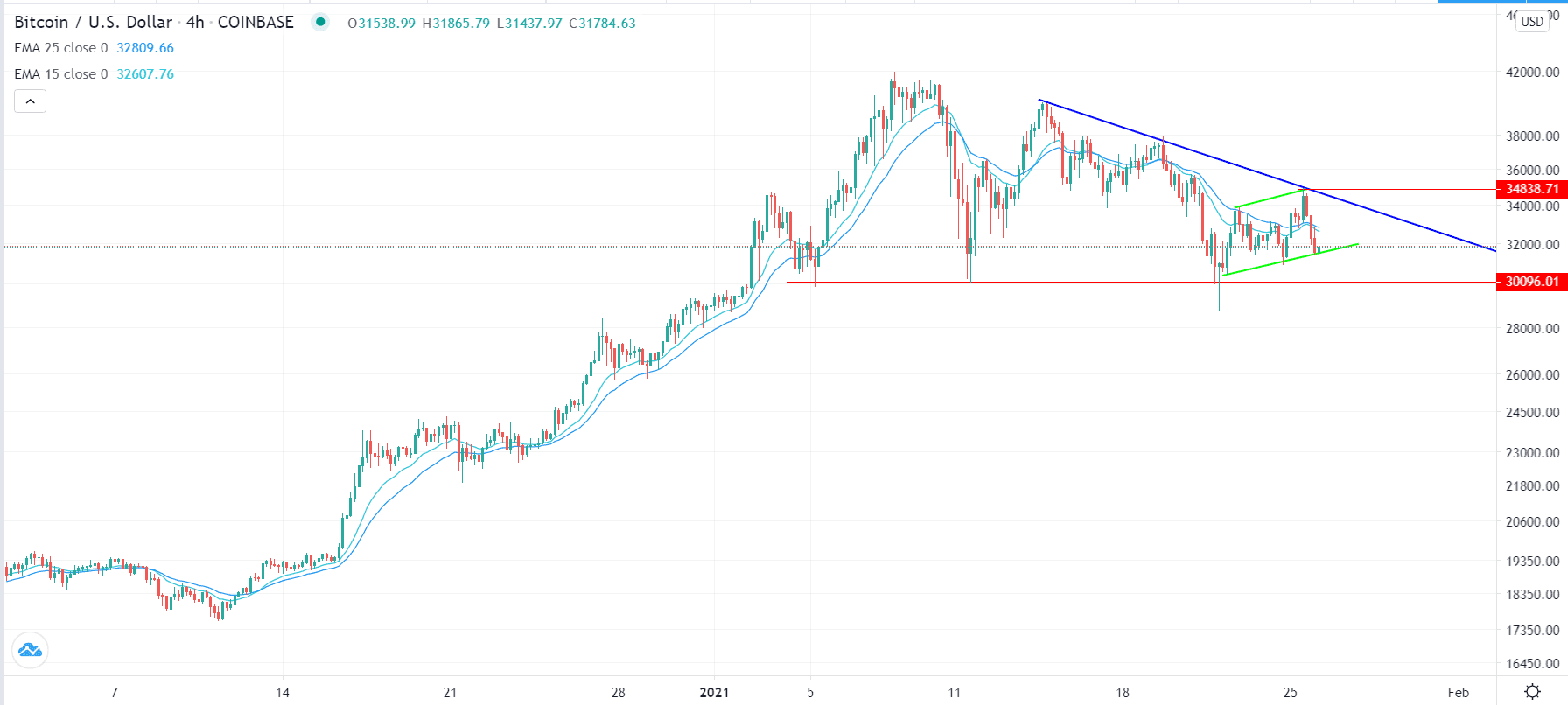

Buy the BTC/USD at 31,700.

Add a take-profit at 34,838 (upper side of the channel).

Set a stop loss at 31,000 (lower side of the channel).

Bearish case

Set a sell-stop at 31,000.

Add a take-profit at 30,000 (psychological level).

Set a stop loss at 32,000.

The BTC/USD retreated in overnight trading after a few days of sustained gains. The Bitcoin price is trading at $31,777, which is lower than the weekend high of $34,926. Other cryptocurrencies also declined, bringing the total market cap to more than $937 billion.

Bitcoin Demand Sliding

The recent rally in Bitcoin was mostly because of the sustained demand by institutional investors like MicroStrategy and Mass Mutual. However, recent data show that demand for the currency has started to wane.

According to analysts at JP Morgan, the pace of inflows at the giant Grayscale Bitcoin Trust “appear to have peaked.” The report looked at the four-week moving average of the inflows. They concluded that the current inflows will not be enough to push the price above $40,000.

The Greyscale Bitcoin Trust, which has about $23 billion in assets, is the biggest crypto fund in the world. Institutional investors prefer investing in it instead of the relatively risky exchanges popular with retail traders.

The BTC/USD is also wavering because of the ongoing debate about stimulus in the United States. Some moderate Senators have started to express criticism of the need for the extra $1,400 stimulus check. They argue that the checks should only be sent to the neediest Americans. The debate has led to a relatively stronger US dollar. Also, it has raised concerns about demand for the currency since most people would have used the check to buy Bitcoin.

Meanwhile, the recent volatility has also pushed more investors to stay in the side-lines. After reaching the all-time high of above $41,000 early this month, the BTC/USD has been relatively volatile. Last week, it declined to $28,600 and then jumped to $34,926.

BTC/USD Technical Outlook

The BTC/USD has been in an overall bearish trend in the past few weeks. It has declined by ~25% from its all-time high. Also, the price is below the descending trendline that connects the highest swings in January. It has also moved below the 25-day and 15-day exponential moving averages. Therefore, there is a possibility that the pair will bounce back as bulls target the upper side of the channel at $34,838. This prediction will be invalidated if the pair moves below the lower side of the channel at $31,600.