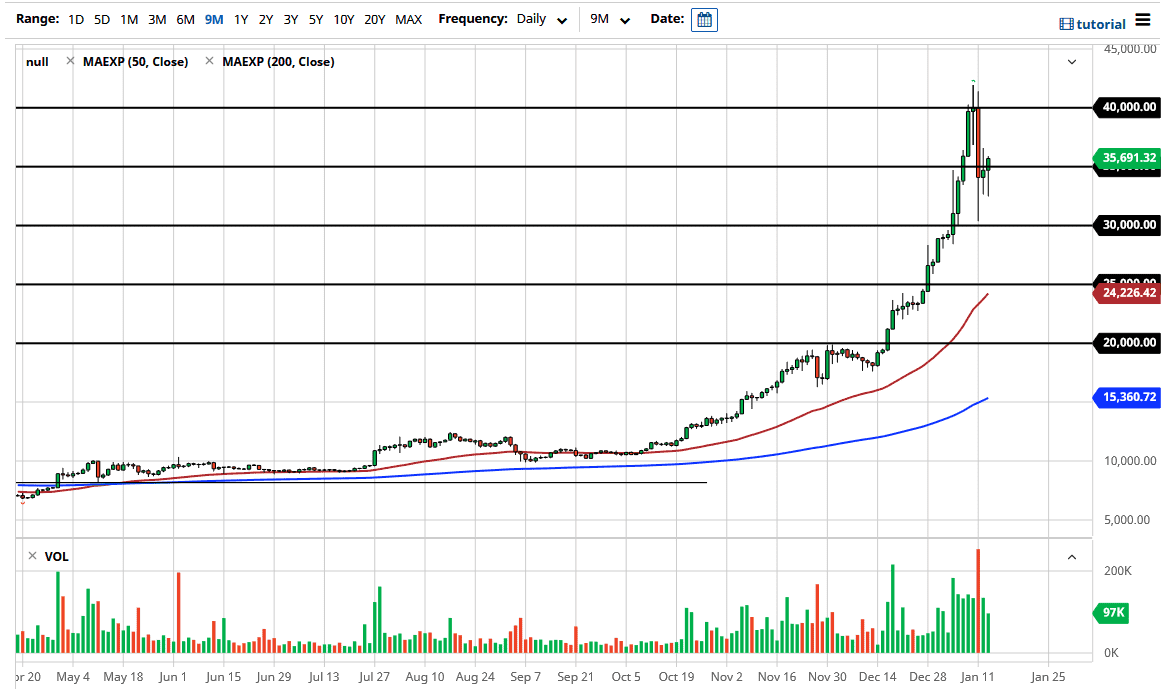

Bitcoin fell again during the trading session on Wednesday but then turned back around to show signs of hanging on to the $35,000 level. The resulting candlestick for the day is a hammer, but it is preceded by a shooting star or an inverted hammer, depending on which way you look at it. In other words, we are still a bit confused and trying to figure out what to do next. The $35,000 level is a strong psychologically important figure, but what you need to see more than anything else is that we have stabilized over the last couple of days.

That is a good sign, but one of the things that does concern me is just how massive that negative candlestick was from Monday. The thing about these types of candlesticks is that they very rarely happen in a vacuum. I am not calling for the end of Bitcoin, but I am saying that there is still a high likelihood of further downward action. The $30,000 level underneath being re-tested would make sense, and if it holds then you could kick off a longer-term move to the upside.

Ironically, most people did not see this coming. I do not understand why, because no matter what the asset, if it rises over 40% in a month it is certainly due some type of correction. Typically, you would see more of a gradual decrease, and that is what I am expecting to come based upon my experience. No, Bitcoin is not different. It still has to respect the laws of gravity and human psychology, which is exactly what drives the market.

What I anticipate will happen is that we may make a bit of a move higher, and then more of a pullback. That is fine, and even if you are bullish of the market and happen to own it, this should not be something that concerns you. Building up a bit of a base is healthy and any uptrend after a major spike higher. If we break down below the $30,000 level, then it is likely that we could go down to the $25,000 level. To the upside, if we break above the $40,000 level I would be fairly concerned, because the higher this goes without some type of meaningful correction, the more unstable it becomes, and it therefore becomes much more dangerous when it does unwind.