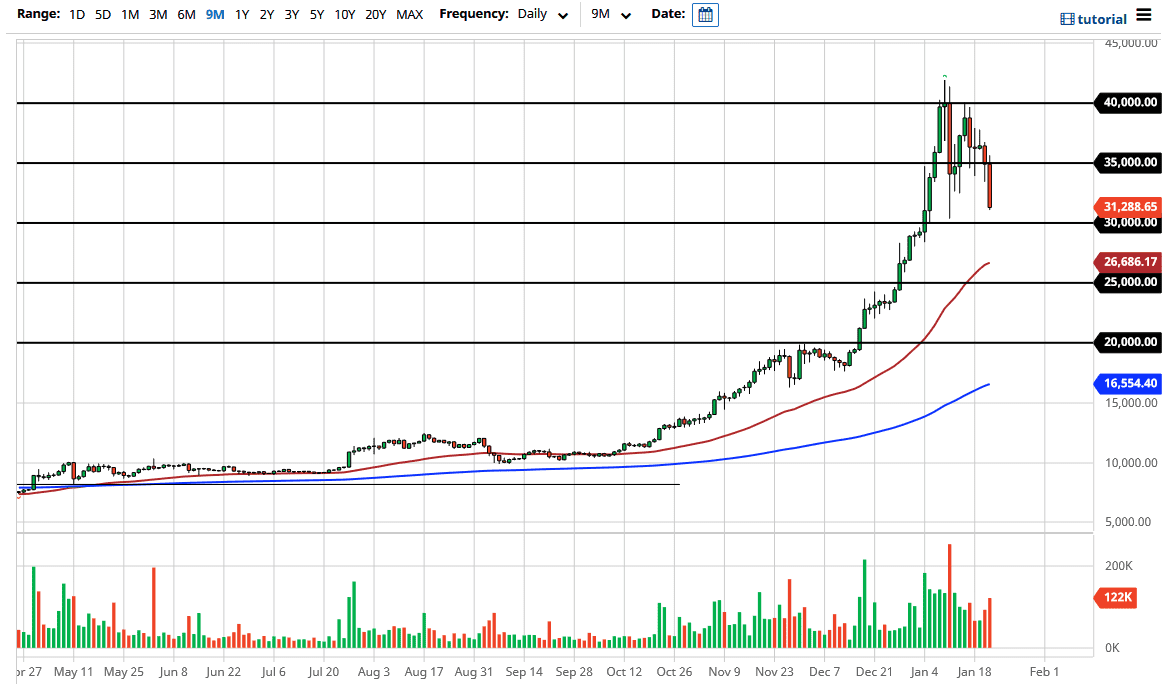

Bitcoin markets fell hard yet again during the trading session on Thursday, dropping 10% during the day. At this point, it certainly looks like we are going to test the $30,000 level yet again, an area that I think if we break down below will more than likely send this market much lower. At this point, it would almost certainly kick off a breaking of a descending triangle, which measures for a move down to the $20,000 level. While I know many people will argue the point, it is likely that a pullback to the $20,000 level would make quite a bit of sense. After all, that is an area from which we broke out of, and therefore I think it makes quite a bit of sense that there would be a lot of people that missed the move just waiting down there.

The size of the candlestick certainly shows you everything you need to know, and if you remember a couple of weeks ago, I said that the massive candlestick that at one point showed a 20% drop during the day was more than likely a sign of something else coming down the road, because those candlesticks do not happen in a vacuum. If we break down below the 30,000 level, the 50 day EMA underneath of course would be technical support but I think a lot of people will be heading for the exits in one fell swoop.

Alternately, a bounce from the 30,000 level could send this market looking towards the 35,000 level. A break above that could open up the door to the 40,000 level, but we need to see the US dollar continue to get sold off quite drastically in order to push the Bitcoin market to that level. All things being equal, it that needs some type of massive stimulus coming down the road. Unfortunately, the Republican Senators have all but poured cold water on hopes of amassing the stimulus package during the day, thereby stabilizing the US dollar. Furthermore, the US dollar was oversold to begin with so that causes issues. Finally, Janet Yellen has suggested that she was going to work against the idea of crypto taking over the financial markets, and slow down some of its “unfettered use.” That being said, it should be noted that the idea of the US government working against Bitcoin will take almost all of the institutional money out of the market. That would be very difficult. While most Bitcoin holders suggest that the crypto currency cannot be stopped by a government, that may be true. However, they can most certainly make it difficult for the users of those crypto currencies. That is the real black swan event just waiting to happen.