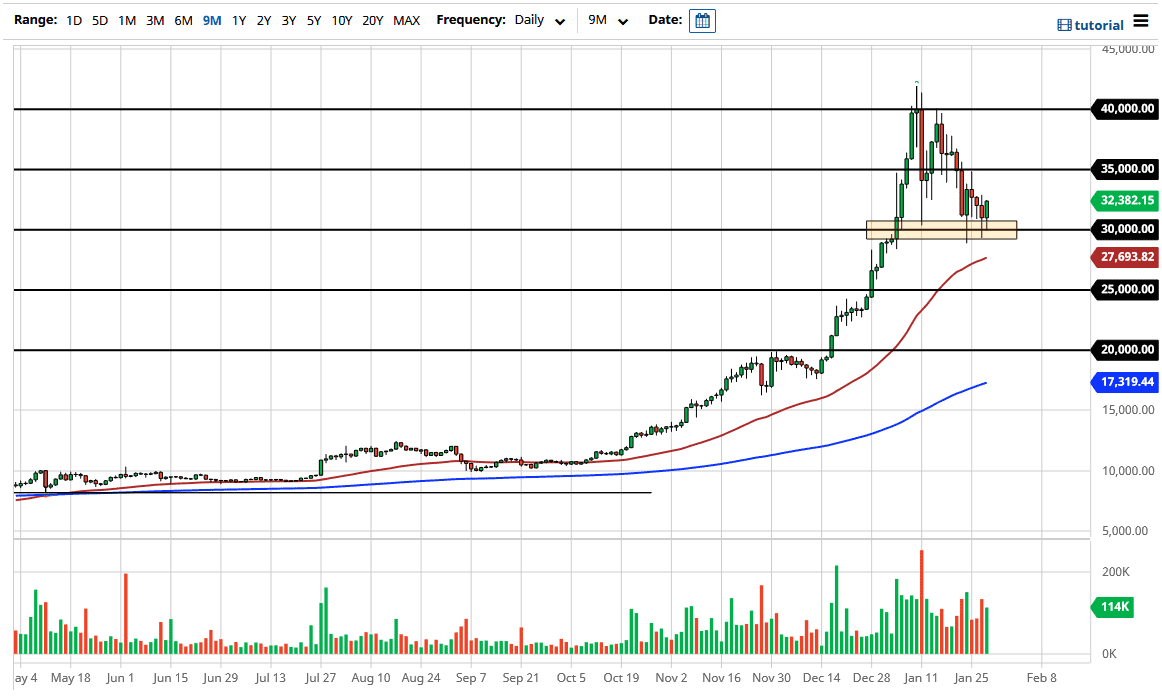

Bitcoin markets fell to reach down towards the $30,000 level on Thursday but have turned around quite decisively to not only rally but close off the very high of the day. That is a good sign, and it does suggest that perhaps we are going to go even higher, perhaps reaching towards the $35,000 level. Once we break above there, then I think you will see more of a rush into the Bitcoin markets. Keep in mind that this is a strong uptrend, but we have had a lot of people shaken out over the last couple of weeks.

To the downside, if we break down below the $29,000 level, then it is likely that we could go down to the 50 day EMA which is closer to the $27,700 region. The 50 day EMA does tend to be influential in this market, as Bitcoin traders tend to be retail traders, and therefore more focused on technical analysis than some institutions will be. Because of this, Bitcoin has a long history of following technicals quite nicely.

That being said, the market is likely to continue the uptrend based upon that alone, and of course it could be a reaction to the US dollar. That being said, we did get a little overdone, so this pullback was necessary. Whether or not it is enough to satiate the fears of those who have been in the market all the way up is different question, but really at this point in time I think that the market also needs to be looked at through the prism of possibly making a descending triangle, but if we continue to go higher than that could negate that potential. That would also show the $30,000 level as being a bit of a floor the market, something that bullish traders would love to see.

Even if we break down from here, I do believe that there is a point where you want to get back in. The 50 day EMA would be the first thing that I pay attention to, but then after that I would be looking at the $20,000 level. That is the area we broke out of previously and would be extreme value. Whether or not we can get there is a completely different question, but I certainly think there would be a lot of people interested. I have no interest in shorting but have bought puts on the occasion over the last couple of weeks.