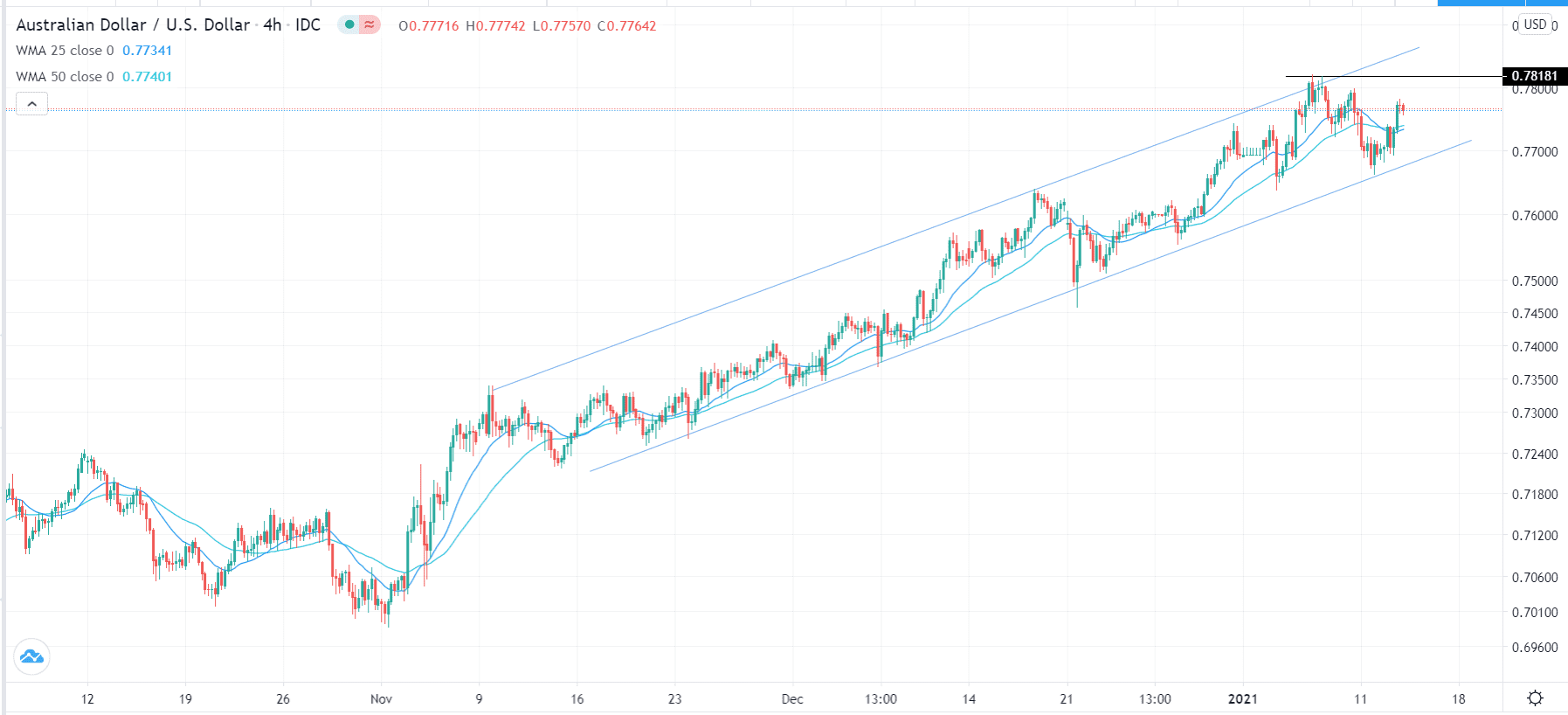

Bull case

Buy the AUD/USD because bulls seem to be in control.

Have a take-profit at the resistance at 0.7818.

Add a stop loss at 0.7700.

Bearish case

Short the AUD/USD at 0.7740 (15-day and 25-day WMA).

Add a take profit at 0.7660, which is the YTD low.

Add a stop loss at 0.7800.

The AUD/USD is little changed, with focus being on the US dollar weakness since there is no economic events from Australia. It is trading at 0.7760, which is 1.28% above this week’s low of 0.7665.

US Dollar Reverses

The US dollar declined during the American and Asian sessions even as some analysts revised their initial calls of the currency. The US Dollar Index is trading at $89.95, which is 0.15% below yesterday’s low. This performance is partly due to the rising US treasury yields that hit a ten-year high yesterday.

Still, some analysts have started pricing in a stronger dollar this year. In a note yesterday, analysts at Deutsche Bank changed tune and turned bullish the currency. They expect the stimulus promised by Joe Biden and other Democrats to outweigh the risk of high taxes.

Joe Biden is scheduled to deliver a speech tomorrow that will focus on stimulus, which he believes is necessary. While the price of the stimulus is not yet known, it will likely boost the stimulus checks sent this month to $2,000. It will also have the previous Democrats priorities like funds for states and local governments and boosting of the unemployment benefits.

Robust stimulus will have mixed results for the AUD/USD pair. For one, it could lead to a stronger US dollar since it will boost the economic recovery, forcing the Fed to raise rates faster than predicted. In fact, in statements yesterday, the Fed’s Raphael Bostic and Raphael Kaplan hinted that the bank will move faster if the economy recovers swiftly.

However, such stimulus will also boost commodity prices by increasing demand. This, in turn, will be positive for the AUD, which is often viewed as a proxy for commodity prices.

The AUD/USD will react to further statements by Fed officials and the Fed Beige book that will come out today.

AUD/USD Technical Outlook

The AUD/USD pair has been on an upward trend in the past few weeks. This trend has been supported by the rising blue trendline and the 15-day and 25-day weighted moving averages. It has also formed an ascending channel on the four-hour chart.

Therefore, the pair will likely continue rising since bulls appear to be prevailing. If this happens, the next level to watch will be 0.7818, which is the highest level this year. It is also slightly below the upper side of the channel. This prediction will be invalidated if the price falls below0.7700.