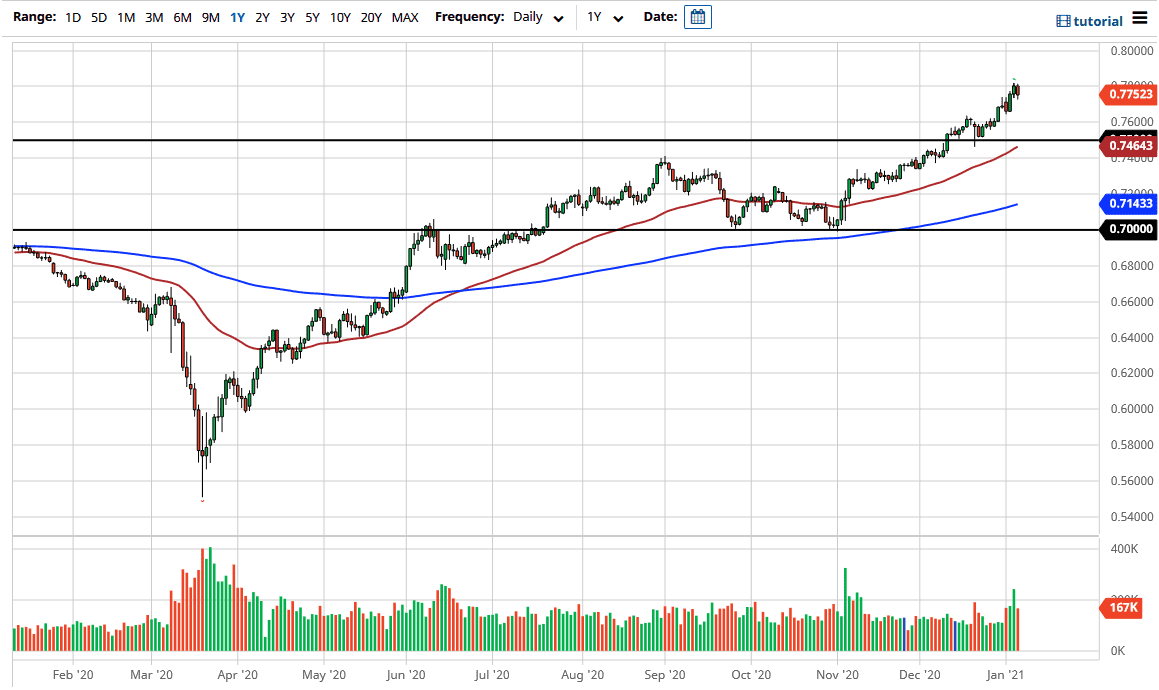

The Australian dollar has pulled back just a bit during the trading session on Thursday, as we await the jobs number. That being said, the market is likely to continue to see a lot of choppiness, but I do believe that longer-term we go higher. Ultimately, the 0.80 level is my target, and I think that we eventually get there. However, I would like to see some type of pullback in order to take advantage of potential value in a market that has gotten just a little bit overextended. Dollar shorts in general are at record levels, so it is very likely that we need to see some type of relief rally in the US dollar going forward. Whether or not it is here is obviously a difficult question.

To the downside, the 0.75 level offers support underneath, sitting at the bottom of the most recent pullback, and with the 50 day EMA reaching towards that level as well, it makes quite a bit of sense. That value hunters will be looking to get involved. At this point in time, it is likely that we will see the market offer value that plenty of people will be looking to jump on board with due to the fact that they may have missed the break higher.

To the upside, I still believe that the 0.80 level gets targeted, but I also recognize that it might be psychologically difficult to break above that level. If we do, then we could really go much higher. In the meantime, it is probably more or less going to be choppy as we have gotten a bit extreme recently, but the market is very unlikely to simply melt down. I think that the 200 day EMA underneath at the 0.7140 level is going to be the “floor the market”, assuming that we could even get down to that level. I believe that the 50 day EMA will be more than sufficient enough to hold things in place.

However, you should keep in mind that the Friday jobs number of course causes a lot of volatility so what I am hoping to see is some type of selloff into the number, or perhaps even after the number. I would be more than willing to buy the dips for a longer-term move, and the 0.75 level is where I would love to see it fall towards, but I do not think it is that low.