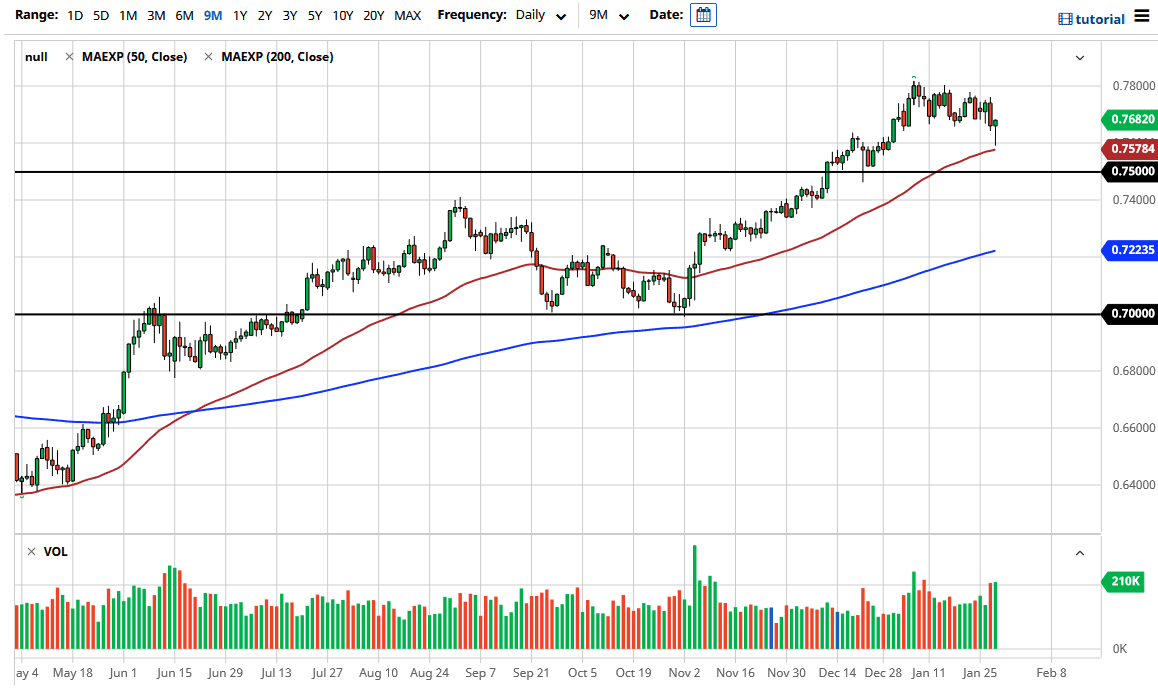

The Australian dollar has pulled back significantly during the trading session on Thursday to reach down towards the 50 day EMA. We have turned around to show signs of support again, in the form of a hammer. At this point in time, the market is likely to see buyers to reach towards the 0.78 handle. To break above that level would open up the floodgates to go to the 0.80 level after that, which is the large figure that I think a lot of traders are paying attention to. In fact, when you look at the monthly charts, you can clearly see that the 0.80 level is a bit of a major area of resistance, so I think a lot of people will pay close attention to it once we finally get there.

The US dollar of course continues to be sold into, and that suggests that perhaps we are going to see the Australian dollar strengthened due to the fact that it is so highly correlated to the commodity markets, and people believe that stimulus is going to drive up the demand for commodities in general. Furthermore, when Fortescue reported out of Australia earlier in the day, they did suggest that iron ore shipments to China were in high demand, and that suggests global reflation still.

Because of this, I think that the market will continue to find plenty of buyers underneath, especially near the 50 day EMA and even if we broke down, I think we be looking at the 0.75 level underneath. The selling of the Australian dollar seems to be a bit of a stretch at this point, especially after the action that we have seen on Thursday. I do believe that eventually we go looking towards the 0.80 level, but it is going to be very noisy on the way up. I think that if you are looking at short-term charts and taking advantage of dips, you should do quite well in this pair. Ultimately, I have no interest whatsoever in trying to short this market, at least not until we break significantly below the 0.75 handle. If that were to happen, then we could be looking at the market pulling back significantly to go looking towards the 200 day EMA. However, until that happens, I just believe that buying the dips continues to work.