The Australian dollar did rally a bit during the trading session on Wednesday as it looks like we are ready to go looking towards the 0.78 handle. This is an area that is obviously important as we have pulled back from there couple of times recently, but at the end of the day this is a market that I think continues to see a lot of upward pressure due to the idea of stimulus and of course of the commodity trade showing signs of strength.

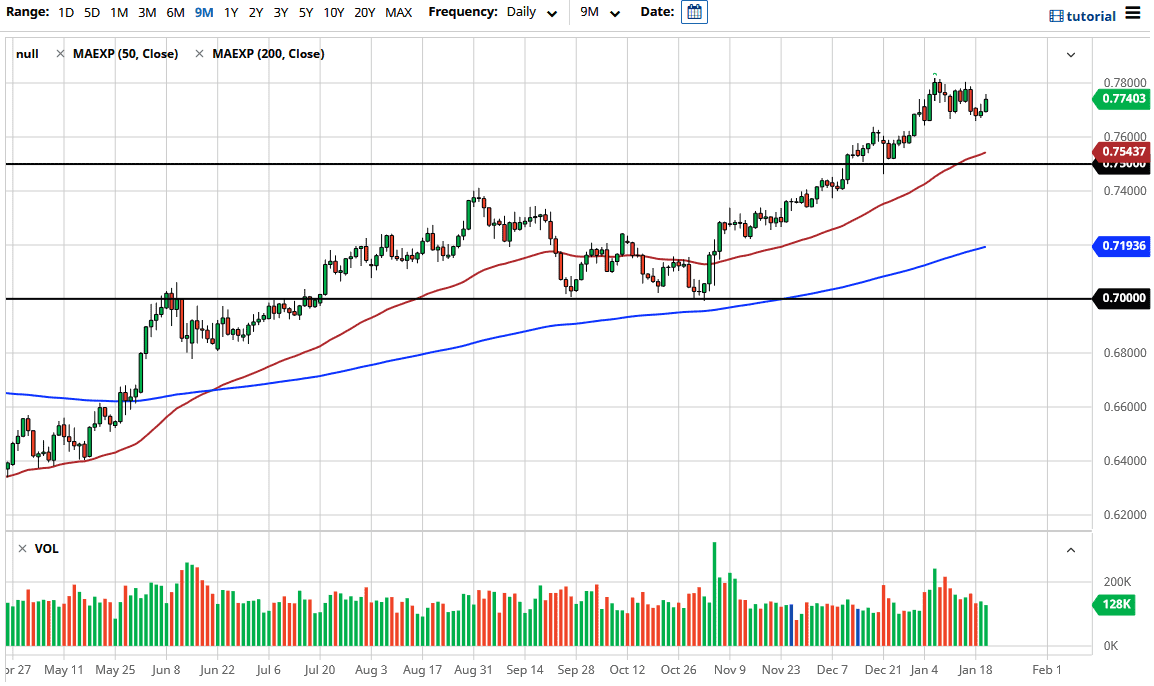

Looking at the chart, you can see that the 50 day EMA underneath probably offers a significant amount of support as it sits just above the 0.75 handle. This is a large, round, psychologically significant figure and you could also make an argument that the gold markets rallied during the trading session probably helped as well. With this being said, I think we continue to see this market as one that people will be buying dips on, as it has been in an uptrend for so long. You could make an argument for a slight bullish flag as well, and therefore I think all things being equal this is a market that has far too many technical reasons to go higher, right along with fundamental reasoning.

If we break down below the 0.75 handle, then we would probably target the 0.74 level only to open up the market to go down towards the 0.72 level. There we see the 200 day EMA hanging about, so that of course will attract a certain amount of attention. The Australian dollar operably continues to rally based upon stimulus in America alone, but if we can get even the slightest hint of inflation coming out of Australia and of course continuing strength coming out of China, that should drive this pair higher over the longer term.

To the upside, I believe that the 0.80 level is your target eventually, perhaps even higher than that. If we can break above that level, then it is likely that we go looking towards even higher levels. Buying on the pullback continues to show signs of value hunting, something that I think the markets will continue to do over the longer term. This does not mean that we will get the occasional significant pullback, but if you are patient enough you should have plenty of opportunities to get long.