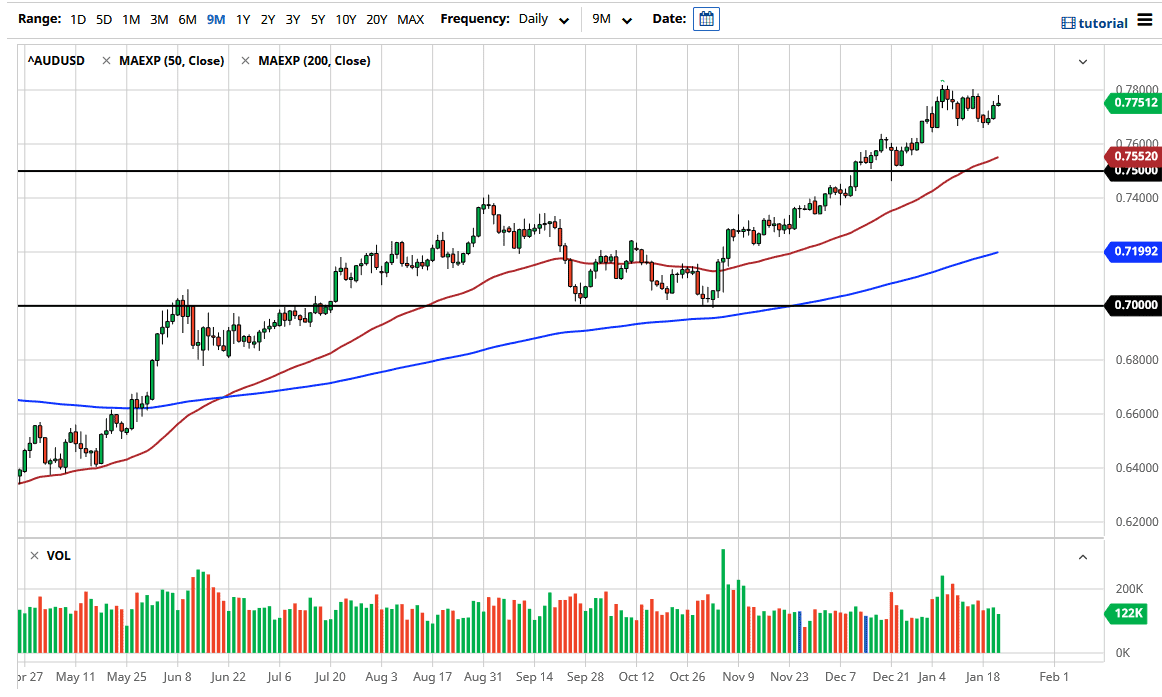

The Australian dollar initially tried to rally during the trading session on Thursday but gave back the gains as we approach the crucial 0.78 level. Above there, it could be considered a decent breakout, and you can make an argument for a bullish flag. However, the price action during the trading session on Thursday was not very encouraging, as this level continues to be a bigger problem than anything else.

The shape of the candlestick of course is a little bit of a shooting star but ultimately, I think that we have enough upward pressure over the longer term. I think the biggest problem you have right now is that the US dollar is oversold and therefore a pullback makes quite a bit of sense. After all, you cannot go straight up in the air forever and you should not want to. The market breaking above the 0.78 level would open up the door for a move to the 0.80 handle, but I do not see that happening in the short term. Longer-term, I can buy that argument that we need to see some type of stimulus passed in the United States.

To the downside I would anticipate that the 0.76 level should be supported, right along with the 50 day EMA. Also, you should keep in mind that stimulus being passed in the United States is not as big of a “slam dunk” as Wall Street wanted it to be. Lisa Murkowski and Mitt Romney both have suggested that they are not necessarily looking to push stimulus through the Senate, and in a Senate that will need a 60 vote majority make it happen, that poses a major problem for the Biden administration. In other words, we may not see stimulus for quite some time and that invalidates the argument of eviscerating the US dollar, at least in the short term.

The Australian dollar would be a prime target for short sellers in that scenario, due to the fact that commodity prices have such a major influence on it. If there is not some major stimulus coming, then it is very likely that we would see the Aussie pulled back significantly.