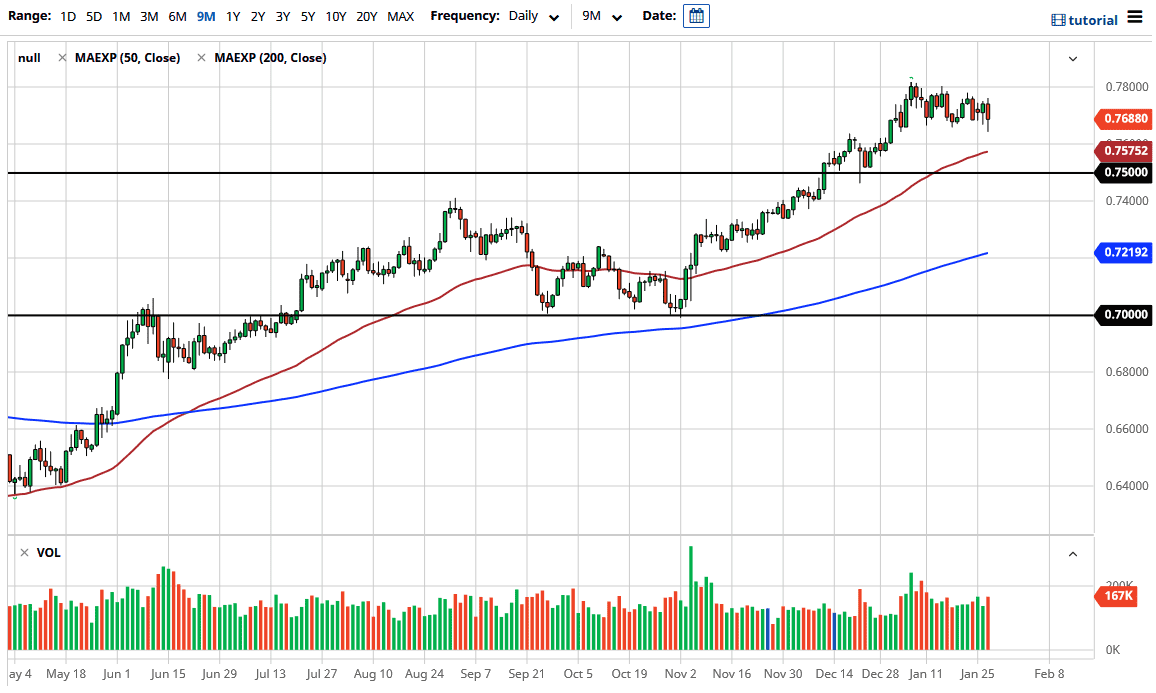

The Australian dollar has fallen a bit during the trading session on Wednesday as we continue to see a lot of digestion of massive gains out there when it comes to things not US dollar. With that being the case, the market is likely to continue to see more of a rounding move here, with an eye on trying to break out to the upside. The Aussie dollar of course is highly correlated to commodities and the entire “reflation trade”, which of course is the narrative that most people are clinging to right now. Ultimately, this is a “buy on the dips” type of situation.

Underneath, the 50 day EMA sits at the 0.7580 level, and I believe extends support all the way down to the 0.75 handle. With that in mind I do not have any interest in trying to short this market and realize that pullbacks will continue to be looked at as potential buying opportunities. In fact, I believe that the 0.75 level will continue to be important, and therefore it is worth paying close attention to it. If we do break down below there, then we may get a more significant pullback. That being said, the Aussie dollar has been very bullish due to the idea that governments around the world were going to throw money at anything they could, thereby driving up the demand for overall harder commodities such as copper and aluminum.

The Federal Reserve continues to keep interest rates at extraordinarily low levels, and therefore I think that continues to work against the US dollar. The question of course is whether or not the economy can actually grow, and whether or not the Federal Reserve will be the “winner” in the currency war that we are starting to see central banks step into.The Federal Reserve is probably one of the best at killing its own currency, so I see no reason to think that will continue to help the Aussie against the US dollar at the very least. All things being equal, if we can break above the 0.78 level and opens up the possibility of a move towards the 0.80 level after that. I think that is eventually what happens, but it is going to be very noisy between now and then. I like the idea of buying dips based upon value if nothing else.