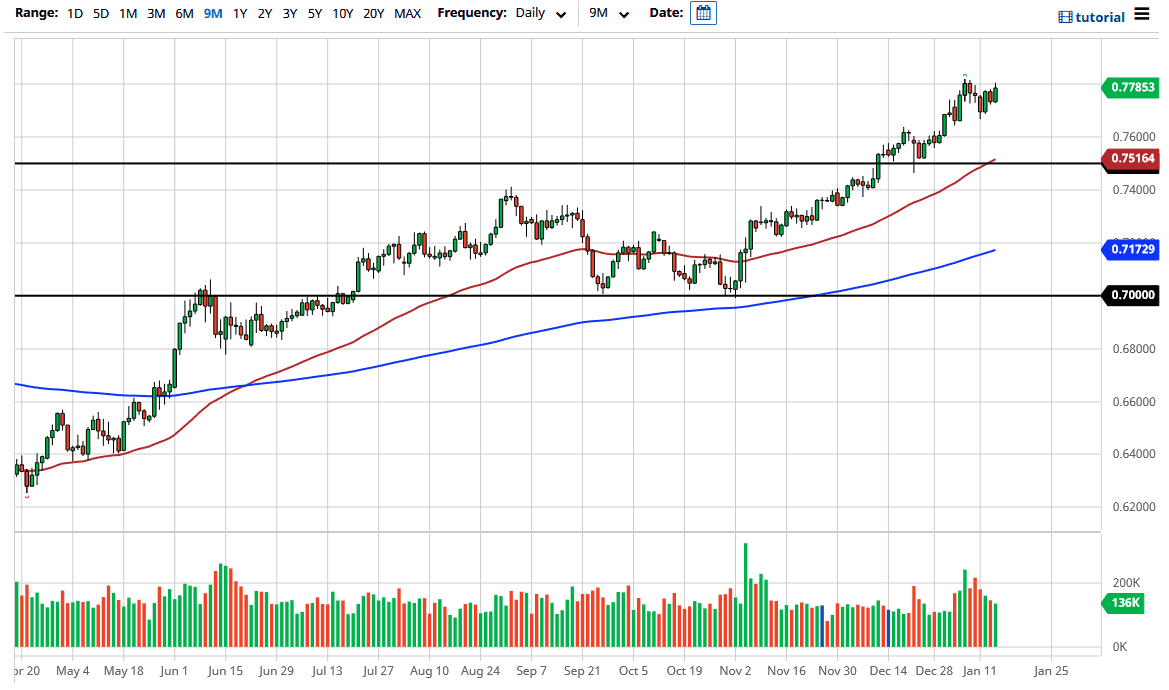

The 0.78 handle has been a bit of resistance previously, and at this point it is likely that we will break through there eventually. This is a bit of a bullish flag, and it does suggest that we could go higher. Based upon the measurement of the bullish flag, we could be looking at the 0.80 level, perhaps even the 0.81 level after that.

Looking at this chart, every time we pull back, I think there will be plenty of buyers looking to get involved and take advantage of “value” in the markets, especially if we get down towards the 50 day EMA which is painted in red on the chart, or perhaps even the 0.75 level, even though that would be quite a significant pullback. The main driver of this currency pair is going to be the fact that the US dollar is being pummeled due to massive amounts of stimulus. However, it is not just about the actual stimulus itself, but the fact that it will have a lot of demand for commodities and of course people will be looking to get away from fiat currencies in general, driving up the value of “hard assets.” This includes gold, copper, iron, aluminum, and many other things that you dig out of the ground. That is where Australia comes in, and supply is a massive amount of all of those things to the rest of the world, with a specific focus on exporting them to China.

At this point, I think we will go looking towards the 0.80 level but at that point I think we would also have to start to ask a lot of questions about the sustainability of that move. It will be interesting to see whether or not the reflation trade can carry through the bulk of the year, but in the next couple of months it certainly looks as if that is how we are playing the markets. Keep in mind that the narrative drives the overall risk appetite, and between stimulus and the idea of massive spending programs driving up demand for commodities, we should continue to see this pair do quite well.