The Australian dollar rallied during the trading session on Wednesday as the US dollar got smoked by several other currencies. The market is reacting to the idea of the U.S. Senate flipping over to Democrat control, which should mean more stimulus, and thereby more selling of the greenback. At this point, it is likely that the Australian dollar will continue to be a beneficiary from not only US dollar weakness, but the fact that the Australian dollar is so highly levered to commodity currencies in general. This is one way for currency traders to play the “reflation trade.”

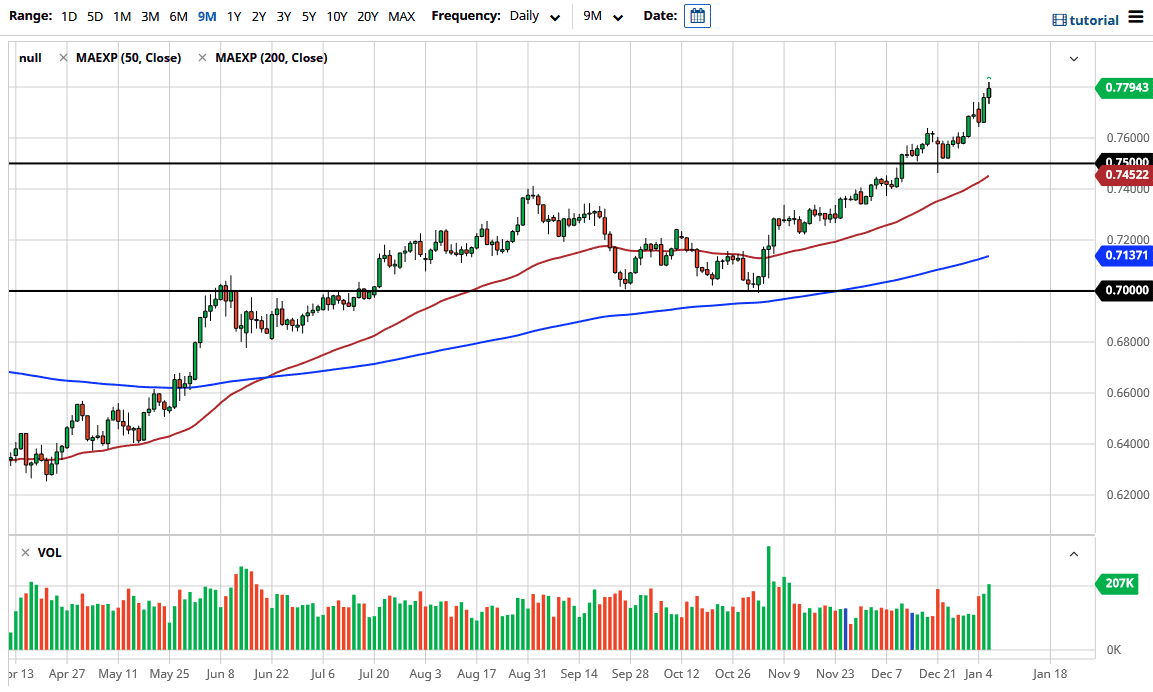

We are simply in an uptrend and that is something that you should not be fighting. The 0.78 level is being threatened, but I think we could see a little bit of a pullback in order to build up the necessary momentum to go higher. Nonetheless, I would not be a seller and I would look at any significant pullback as a potential buying opportunity, in a market that I believe will continue to see a lot of upward pressure over the long term.

The 0.76 level looks to be supportive, and most certainly the 0.75 level will be. The 50-day EMA is starting to race towards the 0.75 handle, so I think the correlation in that general vicinity works out quite well for traders to go long. I have no interest in shorting this market and I believe that it is only a matter of time before the US dollar falls apart. The market should continue to go towards the 0.80 level given enough time, as we have been in an uptrend for a while and it is the next major resistance barrier that we will be paying attention to from a long-term standpoint. The US dollar is a bit oversold in general, though, and when you look at the US Dollar Index, it is clearly trying to support itself. So, I think that the volatility will be the mainstay here, but the Aussie certainly seems to be one of the most likely areas where you will see US dollar weakness. Between the greenback falling and the commodity markets picking up, this should end up being one of the better performing currency pairs.