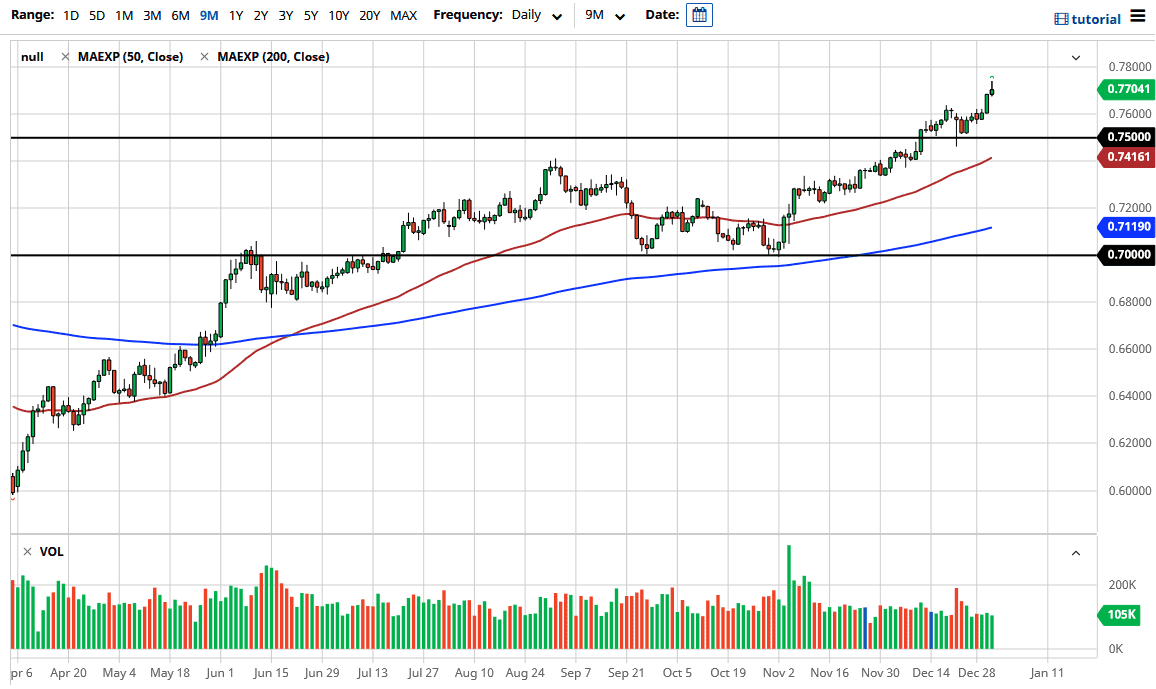

The Australian dollar rallied initially during the trading session on Thursday in what had been a very strong move early in the session. The Aussie then gave back quite a bit of the gains to form a shooting star, which is not a huge surprise considering that many traders will have been squaring up positions heading into the new year. Furthermore, volume was probably very thin to begin with, so it probably did not take too much to push this market higher in the first place.

The shape of the candle - the shooting star - is a negative signal. That does not necessarily mean that I am willing to sell this market; rather, I would be much more likely to wait for a pullback in order to take advantage of value. Underneath, the 0.75 level is an area in which you should see quite a bit of support, extending all the way down to the 0.74 handle. At the 0.74 level, the 50-day EMA is starting to approach, and I think that also offers support.

Looking at the chart, we will see plenty of buyers willing to step in and pick up value as it occurs, especially considering that the Federal Reserve continues to flood the markets with greenbacks. With that, and with stimulus a major influence coming out the United States, it is likely that we will see the Australian dollar as a major beneficiary, not only due to the fact that it is not the greenback, but also considering that it is so highly levered to commodities. The reflation trade is something that many people will be playing not only due to stimulus, but the idea that the vaccine is going to turn the economy around again. Whether or not that is true is a completely different question, but it does not really matter if it is true or not; as long as the market believes that it is. Underneath, the 50-day EMA continues to race higher, and I think that it is only a matter of time before the 50-day EMA makes its presence felt yet again. To the upside, I believe that the market will eventually go looking towards the 0.80 handle.