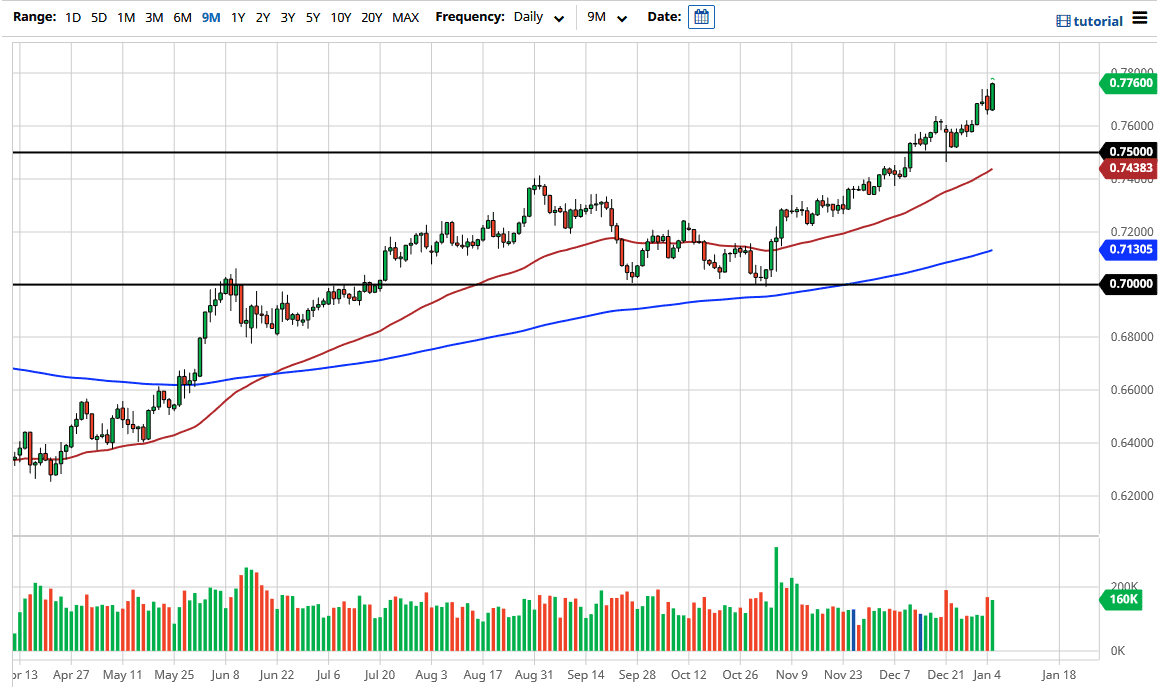

The Australian dollar rallied significantly during the trading session on Tuesday to break above the 0.7750 level, an area that I had listed as a minor resistance barrier. Now that we are above that level and closing at the top of the candlestick, the Australian dollar is showing that it is ready to continue going higher. This will be exacerbated by the idea of stimulus coming out the United States, and the US dollar will continue to lose strength.

The Australian dollar is very sensitive to the reflation trade, due to the fact that it is highly sensitive to commodities in general, and there are various commodities exported by the country. The Chinese looking to reinflate their economy should drive the Aussie dollar higher as well, as it will represent a lot of spending in that economy. Remember, the Australian dollar is also very sensitive to the idea of Chinese spending, due to the fact that the Chinese yuan does not freely float, and most Forex traders will use the Aussie dollar as a proxy for the currency.

At this point, we will see pullbacks as potential buying opportunities. The 0.75 level should be thought of as a “floor of the market”, as it should continue to support the overall long-term trend, with the 50-day EMA reaching towards that level as well. I do like the idea of buying pullbacks. However, we may not get one, as this could be a huge signal that we are ready to take off yet again.

The 0.80 level above should be a target, due to the fact that it is a large, round, psychologically significant figure and an area where we have seen both support and resistance in the past, so it is very likely that we would continue to see that level attract a lot of attention from both the bullish and the bearish traders. Once we break through there, it should continue to send this market much higher. At this point, I would be rather surprised to see this market break down below the 0.75 handle, but if it did, then I think we would be looking at the 200-day EMA, which is marked by the blue indicator on the chart.