As they are looking to gradually increase production, this should not put too much of a shock to the system of supply and demand, and therefore gives the ability for the market to rise just a bit. Furthermore, we have a deteriorating US dollar and that has been putting upward pressure on the crude oil market, so that is another thing to pay close attention to as the US Dollar Index continues to drift lower.

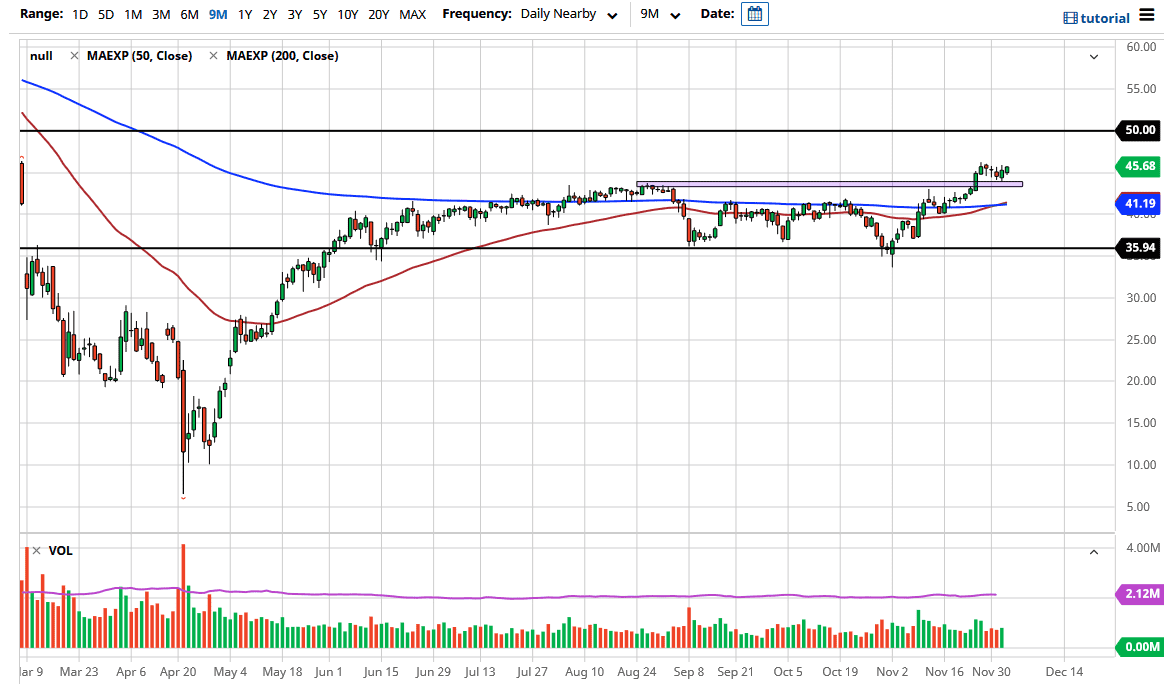

Looking at the chart, you can see that the $43 level was a significant break out and has been retested for support. Since then, we have seen buyers jump into the market and suggest that it is time to go higher. I believe at this point we are probably looking for a move towards the $50 level, and therefore I think that the buyers will be interested in every short-term debt. We do have the Non-Farm Payroll numbers coming out during the trading session on Friday, so that will make quite a bit of volatility jump into the marketplace. With that being the case, I think it is only a matter of time before we see a push higher, but if we get a pullback that could be thought of as a potential buying opportunity. After all, with the deterioration of the US dollar that does continue to push things higher, and if we do get a bad jobs number, it is likely that traders on Wall Street will initially flinch, but then start the process of convincing themselves that it means the Federal Reserve will have to step in and do something, not to mention the U.S. Congress which will be looking to flood the market with stimulus again. In other words, no matter what happens it is likely that we will see buyers come back into this market to pick up any breadcrumbs that people leave. It is not until we break down below the $42 level at this point that I would consider selling. Furthermore, for what it is worth the 50 day EMA has just crossed above the 200 day EMA.