The West Texas Intermediate Crude Oil market rallied during the trading session on Thursday in order to express its hope on more stimulus. There are talks of minor progress and some of the latest statements have been a bit more positive, and it suggests that we could see a continued push higher in general based on the idea of more demand coming down the road. I think this is a bit of a fallacy, because we are far too much in the way of being oversupplied to think that we are suddenly going to see a huge overrun of demand. Rig counts are lower than they have been in years, so there is still a significant amount of supply to chew through but ultimately, I think we will eventually get a bit of a moment of clarity.

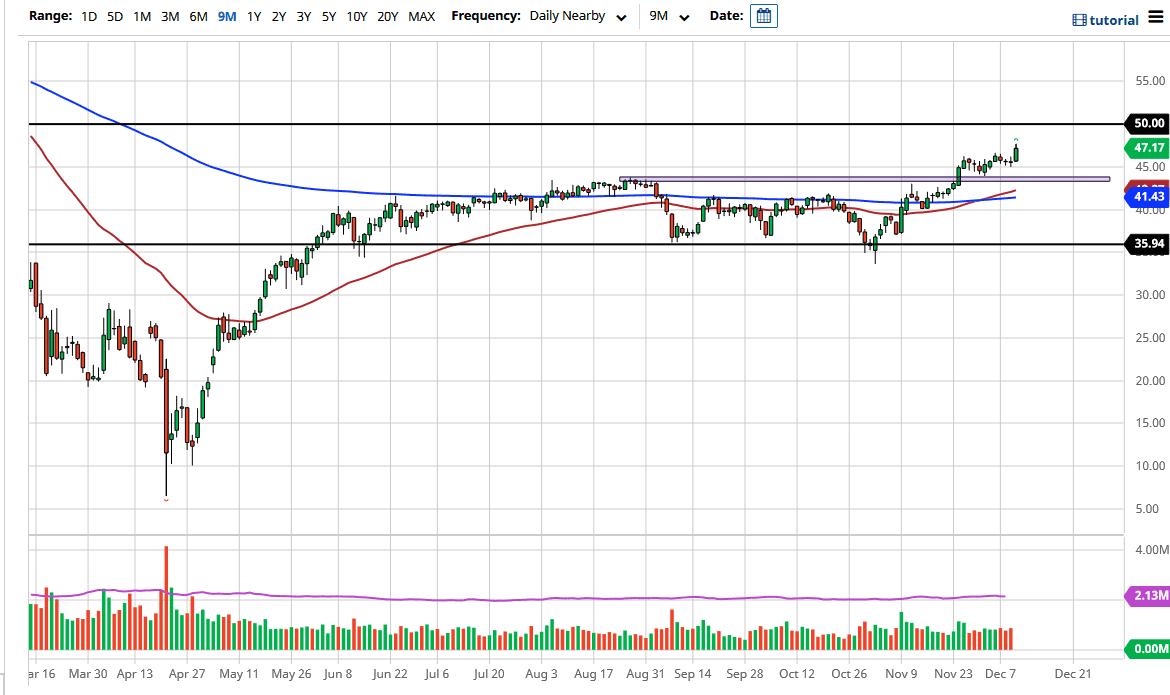

In the short term, I believe we will go looking towards the $50 level above, which is a large, round, psychologically significant figure, and therefore will attract attention. It will be a magnet for price, but I do not think we will get there right away. The action on Thursday was very strong, breaking above the recent trading range and showing that we have a bit of a push to the upside. Short sellers will probably be covering positions, so the “short crude oil” trade probably still needs to unwind a bit. Whether or not we can break above the $50 level is a completely different situation.

To the downside, the $43.50 level should offer significant support, as it was so resistive recently. Furthermore, we have pulled back to test that level for support and it does look like it is going to hold. Given enough time, I do think that we will have to question the $50 level, and if we were to break above there it would be a huge win for the bullish traders out there. I do not think we will slice through there anytime soon though, because at the very least there should be a significant “pushback” in that general vicinity. I think buying short-term dips probably continues to be the best way going forward in this market for the next several weeks.