The West Texas Intermediate Crude Oil market initially tried to rally during trading on Monday but gave back the gains to see negativity. The market is likely to drop from here and buyers will then jump back in. After all, the crude oil market is highly influenced by multiple factors, not the least of which will be the US dollar itself. The US dollar gained a bit of strength during the trading session on Monday, so the currency headwinds have worked against the value of commodities in general.

Another thing to worry about is demand. Yes, stimulus has been signed in the United States, but demand had been dropping long before the coronavirus hit, so one has to wonder how much of that has changed. I did some work today on a report about Chinese importation of crude oil from the United States, which is 13-fold what it was in November of last year. I have a hard time believing that that has not influenced this market as well. The question is, how much longer will China import like this?

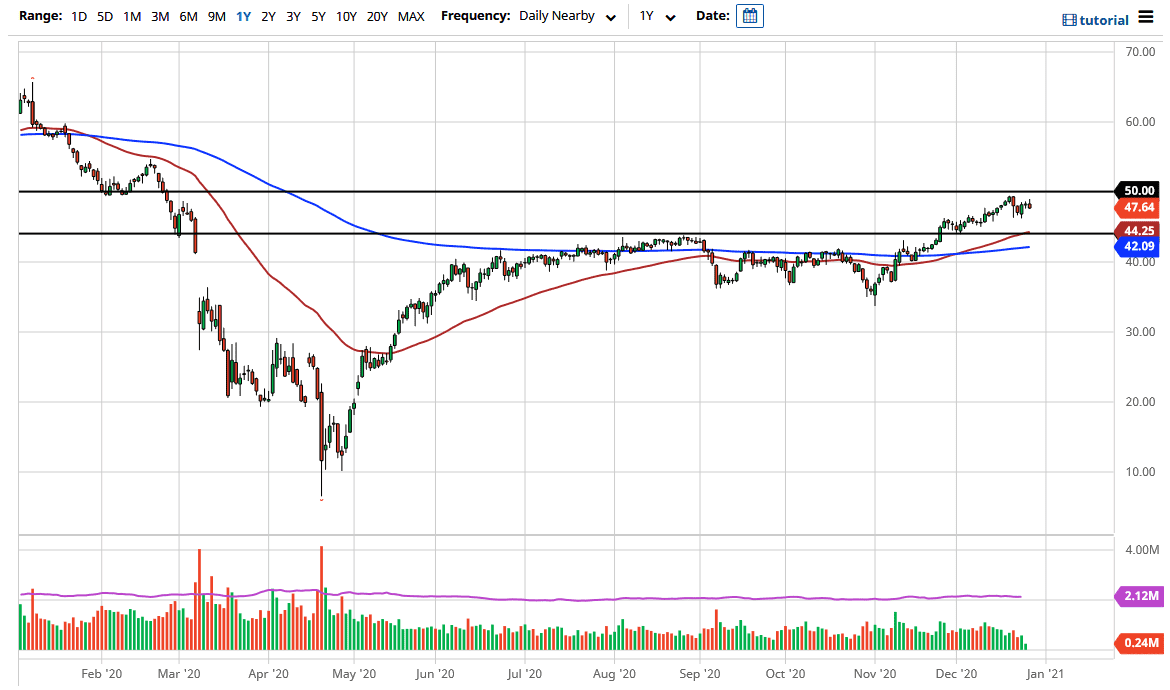

The $44 level underneath is significant support, reinforced by the 50-day EMA which is sitting right there as well, so any pullback is probably somewhat short-lived. To the upside, the market has built a psychological resistance at the $50 level. The $50 level will attract a lot of attention, as it has offered resistance recently as well. Beyond that, the candlestick for the trading session on Monday is a bit of a shooting star, which suggests that we will probably pull back from here. It is only a matter of time before we bounce around in this area, and you should keep in mind that at the end of the year we will continue to worry about liquidity, with the market looking for direction. I do not think we will get it over the next couple of days, so a short-term pullback followed by a short-term bounce is what I am expecting to see. If we do break out or break down, it could be rather sudden due to the thin trading conditions.