The West Texas Intermediate Crude Oil market pulled back during the trading session on Friday as we headed into the weekend. That was expected, considering that stimulus talks are still sluggish in the United States. The idea of crude oil rallying is more about the “reflation trade”, as stimulus talks should in theory bring down the value of the greenback, while throwing money at things such as construction. Flooding the markets with liquidity gives traders an idea of the greenback falling as there will be more supply than demand, and people will look to protect wealth by buying commodities right along with construction.

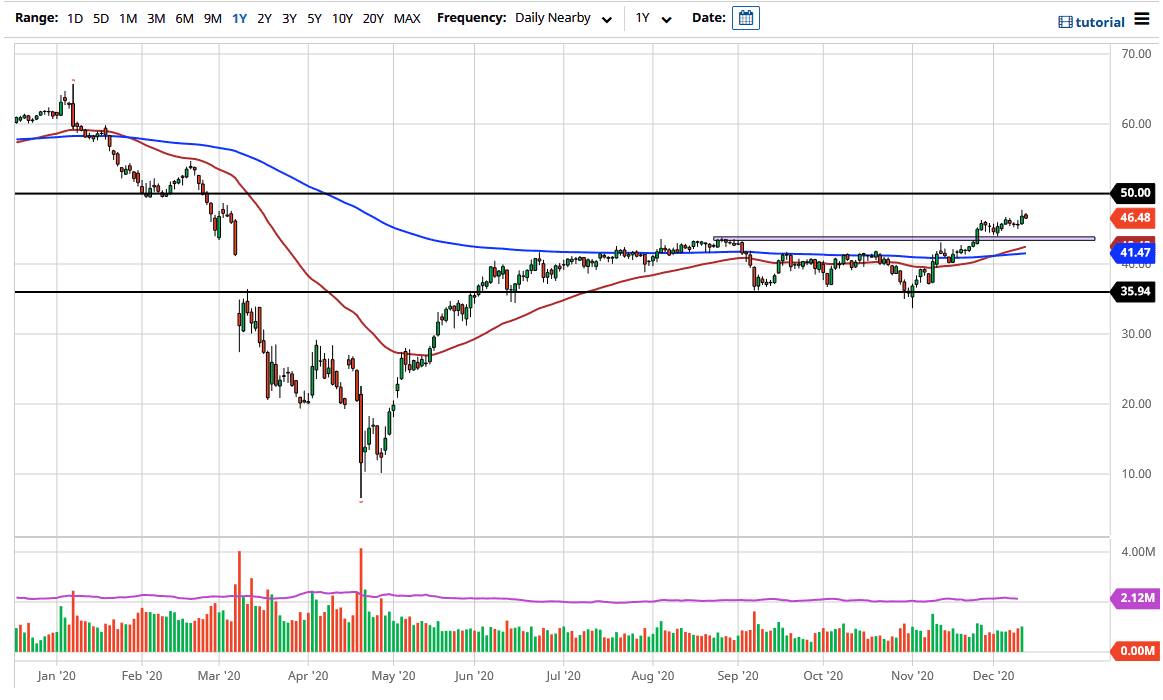

Demand for energy is a little lackluster, so it looks like this will be a short-term rally towards the $50 level, but breaking above there will take a significant amount of data to push things forward. Looking at this chart, there is a significant amount of support at the $43.50 level, above which we had broken out. We should also keep in mind that the “golden cross” has recently happened, so some of the longer-term traders may be getting involved.

One of the things worth paying attention to is the Baker Hughes Oil Rig Count which came out higher again during the trading session. This means that there will be more supply coming down the road, which is part of why I think the upside is somewhat limited. The one main driver will be the value of the US dollar, so if we see the US dollar falling off a cliff, that could make this market overshoot the $50 region.

To the downside, if we were to break down below the $43.50 level, we would go looking towards the 200-day EMA, perhaps even lower than that. But that is the least likely of scenarios after the most recent breakout. If we were to break above the $50 level, then I will have to pay close attention to re-evaluating the entire situation and figure out whether it is a demand scenario, or simply a significant dollar move.