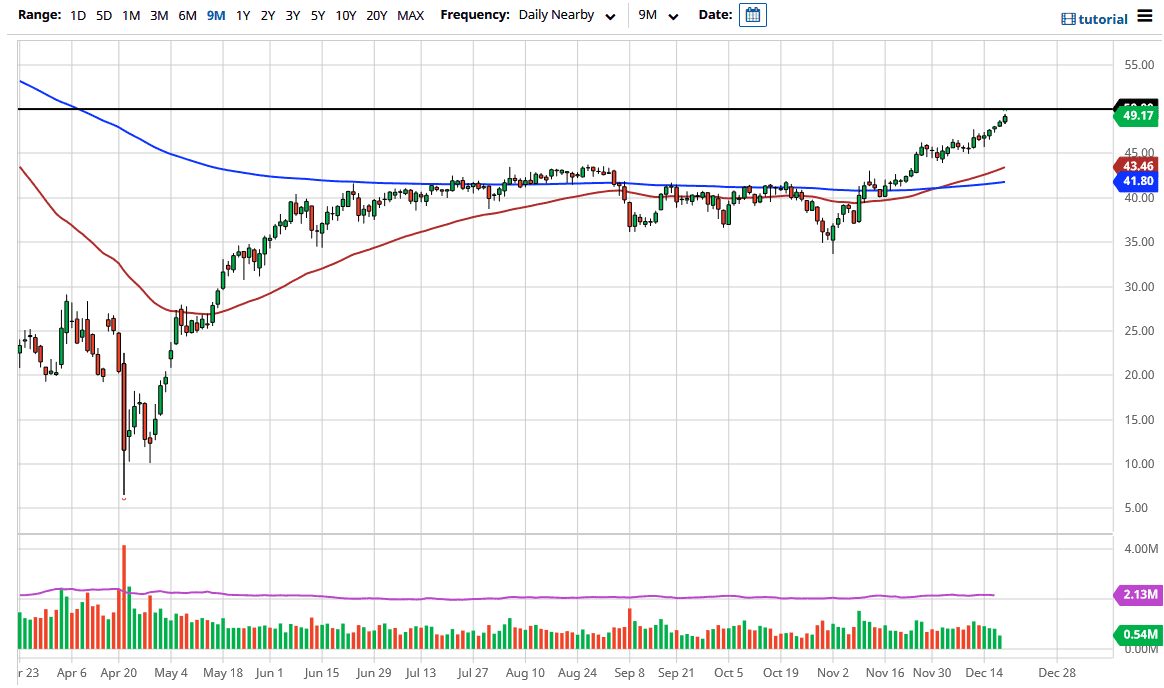

The West Texas Intermediate Crude Oil market rallied during the trading session on Friday as we continue to wait for stimulus. It does look like it is going to happen given enough time, so people are getting optimistic when it comes to crude oil, along with the idea of a vaccine opening up the economy again. This is wishful thinking, due to the fact that we had an oversupply of crude oil before the pandemic, and we are starting to see the Rig Count climb again. However, you do not fight the market, and I recognize that it simply wants to test the $50 level. If it can get above there, then it could really start to press a lot of shorts, and perhaps run to the $52.50 level.

Longer term, there is a massive short selling opportunity coming, so I would be cautious about putting far too much money into this market. Nonetheless, it certainly looks as if we will continue to buy the dips, and that means that we are looking for an opportunity to pick up value going forward. The US dollar will have its say, and the US Dollar Index has been falling rather hard. If it does break down below the 88 level, oil could spike rather drastically, due to the currency story.

Eventually, though, people will start to pay attention to the fact that demand simply is not there, so crude oil will probably take a massive hit sooner or later. I do not expect to see that in the next week or two, so between now and then I would be buying short-term dips for short-term trades. Furthermore, it is difficult to fight this type of move because it based on so much over-exuberant trading. If you really want to jump in early and start shorting, you could probably buy puts, but right now I see no reason to do so. Be cautious, but at this time you have to be bullish because everybody else is. Once we get above the $50 level, then we could see another spike higher; but again, I am looking for signs of exhaustion to start shorting for a longer-term trade.