The West Texas Intermediate crude oil market initially pulled back a bit during the trading session on Wednesday as we continue to see a lot of choppiness in this market. Keep in mind that the inventory numbers were somewhat mixed during the trading session, so the news has now come and gone and is “out of sight, out of mind.”

The crude oil markets tend to be moving based upon stimulus and the idea that perhaps demand will pick up due to stimulus measures being taken by the US government, as well as many others. However, one thing that people have not been paying attention to is that China has been hoarding crude oil over the last month or so, so part of the demand equation might be just a little bit skewed and perhaps overinflated as far as pricing is concerned.

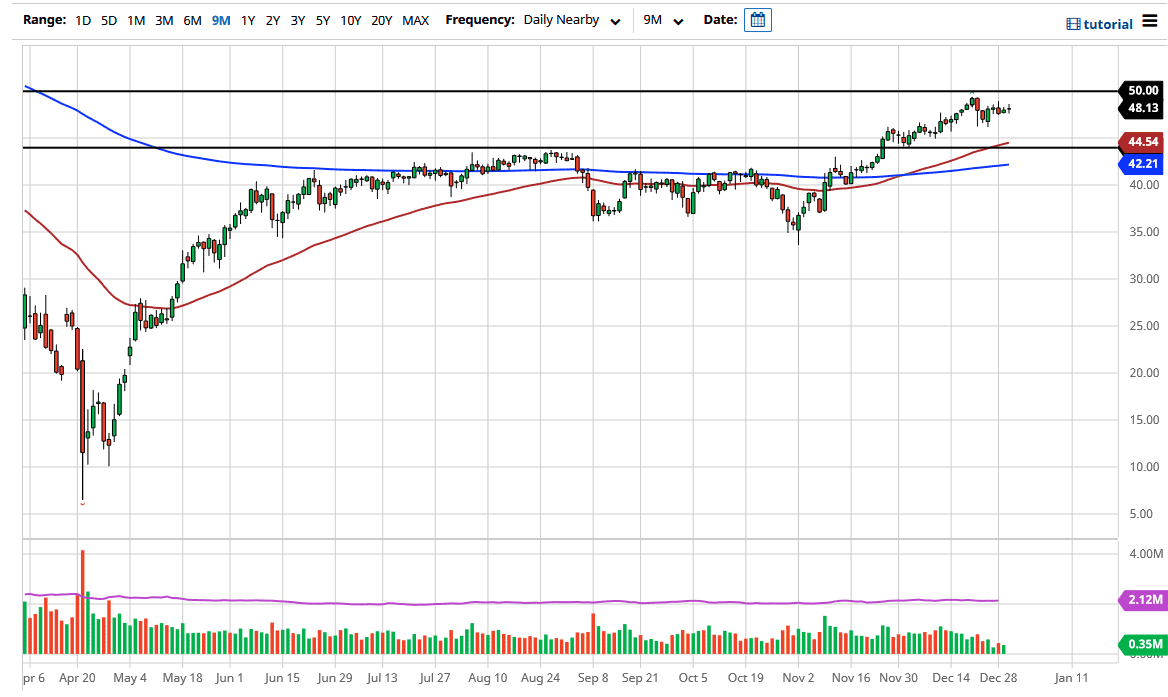

In the short term, I think we will go looking towards the $50 level, which is a large, round, psychologically significant figure and will attract a certain amount of attention regardless. Whether or not we can break above there might be a completely different question, but at this point we are at least going to try to get there. The New Year’s Day holiday is what people are paying more attention to right now, so keep in mind that liquidity is going to be very thin and the trading session will be shortened on Thursday.

The $44 level underneath is support, as is the 50-day EMA which is just above there. Any move towards that area should be a buying opportunity. We can break above the $50 level, at which point it is likely that we can make a move to the upside, but I think it would be somewhat limited as sooner or later people will start to focus on the fact that demand just is not there. Beyond that, demand was very soft before the pandemic, so it is hard to imagine that suddenly things are going to be rosy and bullish from a demand perspective. One thing that is offering hope for crude oil is the US dollar falling, which is something that could help continue to power it higher.