The West Texas Intermediate Crude Oil market continues to be somewhat sideways in general as we try to figure out what to do next. The market moved rather negatively during the day as OPEC suggested that the demand for crude oil in Q1 of 2021 is going to be much lower than previously thought. That will bring down the idea of demand pushing a price. The market is still looking at stimulus as a potential savior, as we see a lot of potential currency destruction due to the stimulus package possibly being rather large.

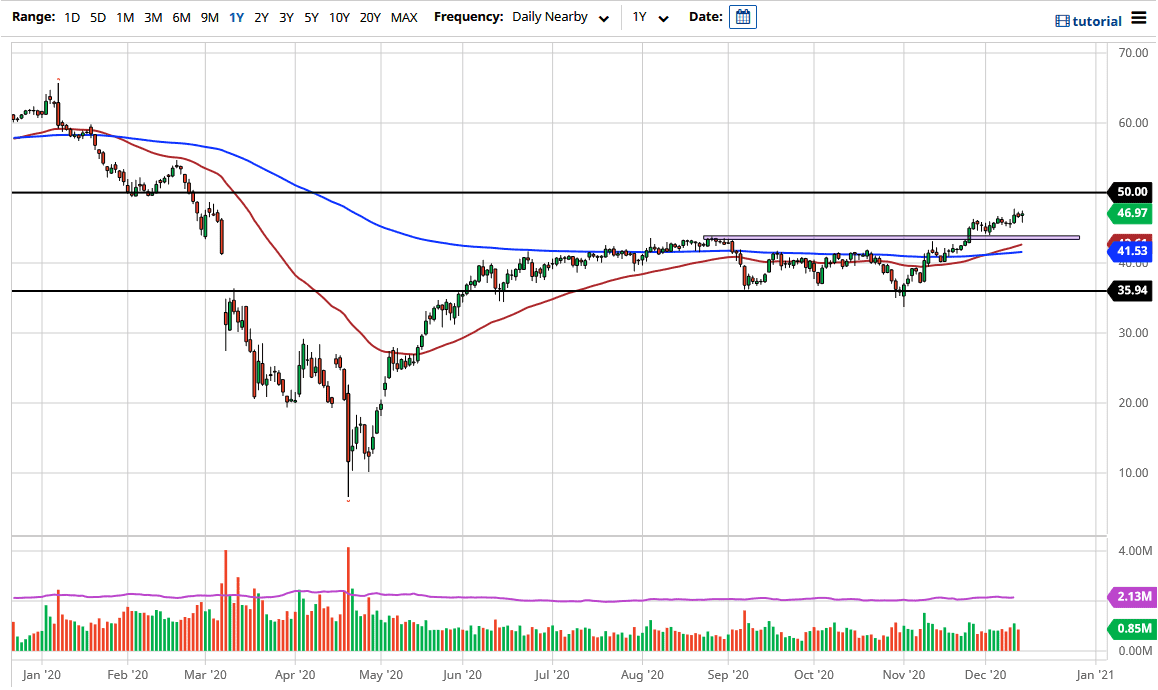

I think the upside is somewhat limited. I have been saying this for a while, as the $50 level above ends up being an area of which people will be very leery. In the short term, it is only a matter of time before buyers jump back in, but whether or not we can break above the $50 level is a completely different story.

We are starting to see more oil rigs being activated, which could bring more supply into the market as well. It is therefore likely that we will continue to see a lot of volatility and downward pressure eventually. Granted, oil will not come online right away, but it should be noted that the most recent inventory numbers were horrifically bearish, so if we continue to see numbers like that, the weight of the market will collapse upon itself. At this point, it comes down to the idea of what happens with the US dollar as the main bullish scenario, as the crude oil markets are priced in this currency. If the US dollar suddenly starts to strengthen, that will have the opposite effect, thereby putting pressure on the pricing power of this market as well. Pay close attention to the US Dollar Index, which could be an indicator as to where we go. It is worth noting that the US dollar is getting very close to major support in that index, so that could be a headwind.