The West Texas Intermediate crude oil market pulled back a bit during the trading session on Tuesday, as we wait to see whether or not OPEC will continue production cuts. It looks as if they will, so there should be some support underneath. TThe United Arab Emirates and Kazakhstan both look a bit hesitant to go all out, so the question now is how long will it be and, perhaps more importantly, how deep will the production cut be?

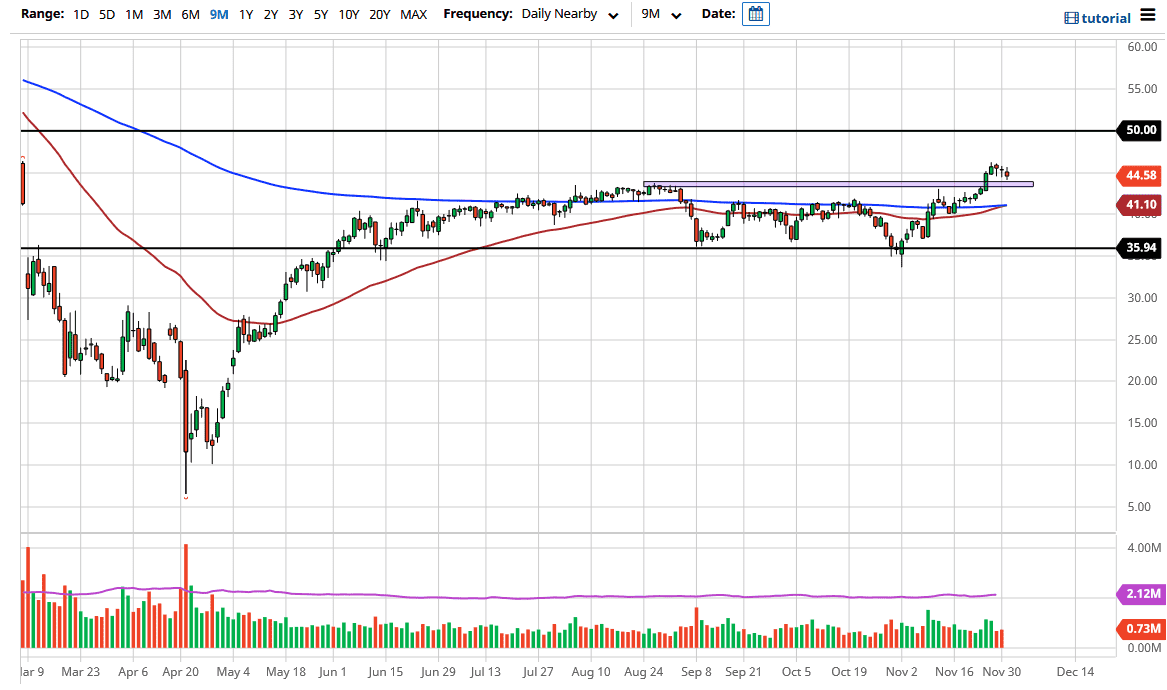

Looking at this chart, you can see that we had broken above significant resistance, and now have tested it again. Until we know the conclusion of the OPEC meeting, the market does not have much to get excited about. However, we did see the US dollar get hammered during the trading session on Tuesday, so that should help the crude oil market. We are looking at the total “reflation trade”, which affects the oil market, as well as the idea is that there will be more demand for crude oil now that they are unleashing stimulus yet again.

This is a short-term rally, as it is likely that the $50 level above will continue to offer significant resistance. The market will find plenty of sellers in that area or, at the very least, will find plenty of profit-taking. It is only a matter of time before we find buyers on dips, so at this point there are plenty of opportunities to go long on short-term charts. I do not have any interest in shorting oil right now, unless they suddenly stop cutting. Until then, I think the market will continue to get a bit of a lift, at least in the short term. However, if we were to break above the $50 level, it could very well signify something bigger. But right now, it is a bit of a stretch to think that far ahead. Expect support short term, and it looks like there will be a reason to go long sooner or later.