The West Texas Intermediate Crude Oil Market initially fell during the trading session on Monday but continues to grind higher in general. This is based on the so-called “reflation trade”, which most traders believe will be the way going forward. With many people out there looking past the coronavirus vaccine and what it means for market strength in general, oil will get a boost. Furthermore, OPEC has settled on a schedule for production, which seems to be putting stability back into this market.

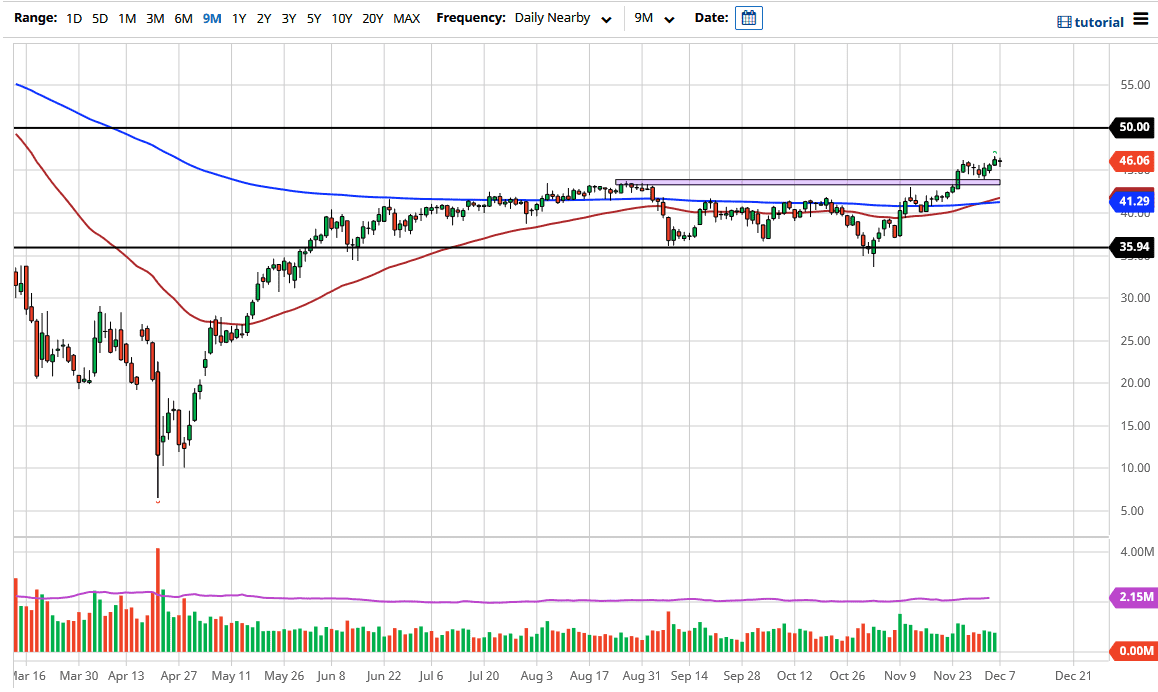

The $43.50 level underneath was a significant barrier that just got broken above, so it should be no surprise that it offers support now. In fact, you could make an argument for a bit of a continuation pattern sitting just above there, which could have traders forecasting that this market will go looking towards the $50 level. That is a large, round, psychologically significant figure that will attract a certain amount of attention. I do not necessarily think that we are going to rip right through it, but to test that level certainly makes sense.

If the US dollar continues to lose value, it would follow that crude oil will gain as a result. After all, crude oil markets are priced in US dollars, so that currency drop means that it will be more expensive to buy crude oil with that currency. Dips will continue to be bought into in the short term and form the bulk of trading over the next couple of weeks. It will take some time to get to the $50 level, and I certainly do not expect this market to break through there right away. This is a level that will probably take several attempts to get through, but in the short term, it looks as if we are going to try to get there. I have no interest in selling crude oil at the moment, and we have just had the “golden cross” - when the 50-day EMA crosses above the 200-day EMA - which many long-term traders will look at as a “buy-and-hold” signal.