The West Texas Intermediate crude oil market pulled back initially during the trading session on Wednesday but continues to find plenty of support underneath. In fact, we are finding buyers at the same place we had seen the previous resistance, so it follows that there would be market memory at play. Furthermore, there are a lot of things going on that could move the crude oil market over the next couple of days.

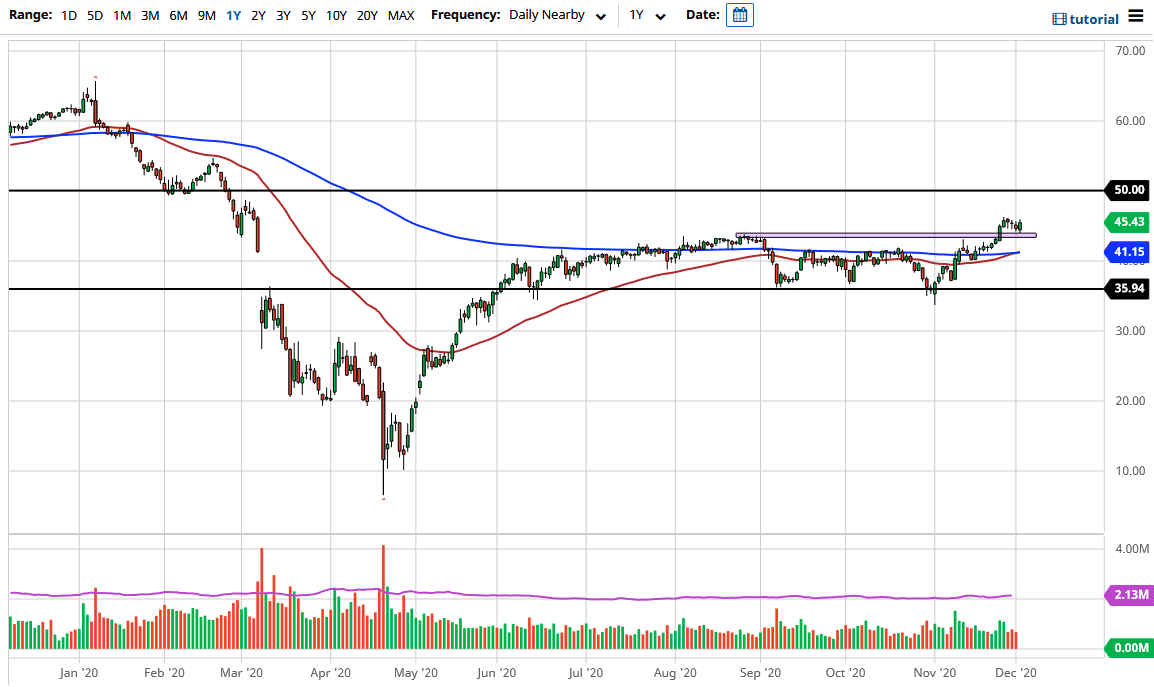

The first and most obvious one is the OPEC meeting, as rumors were spread during the day that OPEC is getting closer to an agreement on the production cut timetable. This should continue to bring buyers into this market and offer support, as further production cuts are exactly what will be needed in order to lift this market with any type of significance. We still have many lockdowns coming, but it should be noted that one of the advantages the market has is that the US dollar is starting to fall in value, so it is likely to continue to put upward pressure on commodities. In the short term, it is very likely that we could go looking towards the $50 level above, which is a large, round, psychologically significant figure and an area that will attract a lot of attention. If we can break above the $50 level, that would be a major victory for bullish traders out there, but at this point, that is as far as my target goes.

Keep in mind that the Non-Farm Payroll numbers will be announced on Friday, which are expected to show a bit of a decline in jobs. That could weigh slightly upon energy, but right now it seems like the only thing that most traders are paying attention to is the world after the vaccine gets released. It is still going to be a very choppy market in general, but clearly the buyers are in control as of late and likely will continue to be for the short term. Of particular note is the fact that the 50-day EMA has just crossed the 200-day EMA.