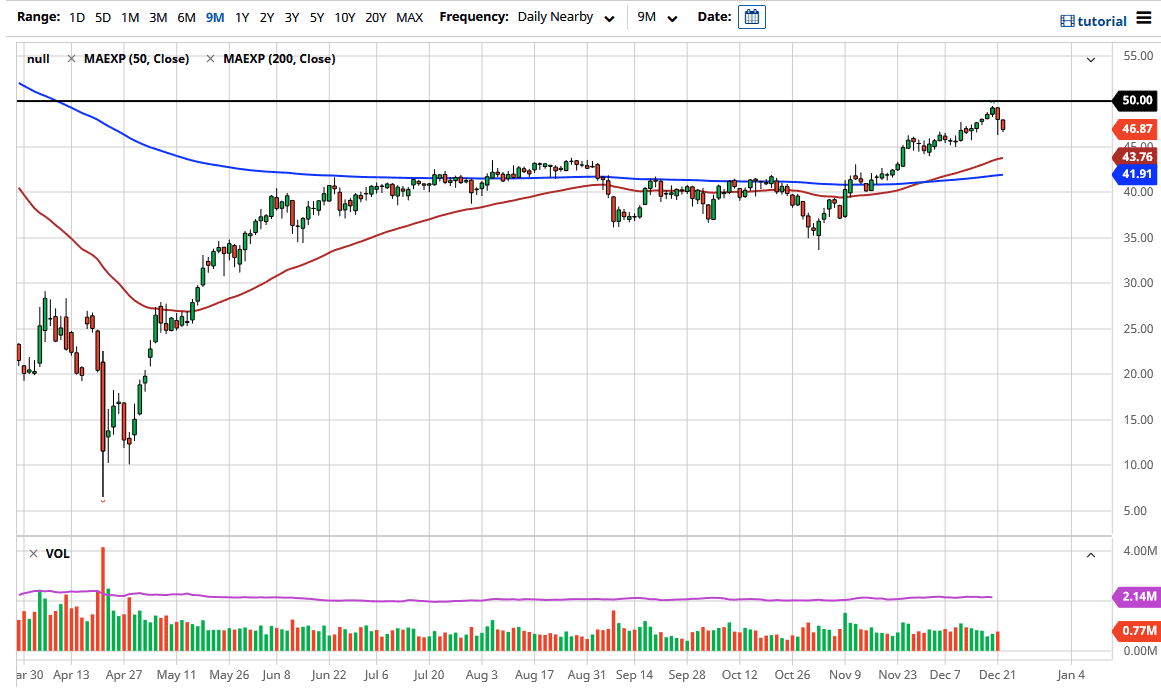

The West Texas Intermediate Crude Oil market pulled back during the trading session on Tuesday as we continue to see people worry about global risk appetite. One of the biggest drivers at this point is Brexit, which continues to go on ad infinitum. By the end of the session the negotiators from both sides of the English Channel suggested that the negotiations are still centering on the fisheries aspect, but it does sound like we are a bit more optimistic in general, based on a handful of comments during the day.

The candlestick for the trading session on Tuesday reached towards the bottom of the Monday candlestick, so it looks like we may try to go looking towards the $45 level where I would expect to see more buyers. One of the biggest drivers of this market is going to be the US dollar, which rose during the trading session. As a general rule, when the US dollar rises rather significantly, it can weigh upon commodities such as crude oil. This is exactly what happened during the trading session from what I can see during the day, so this is a short-term phenomenon.

To the upside, the $50 level continues to be major resistance, so the market will use that as a target. If we can break above there, then obviously the crude oil market will go higher, as it should release quite a bit of inertia. Occasionally, we could get a pullback, but they will continue to be opportunities that short-term traders use to their advantage. We are at the end of the year, and it is likely that we will continue to see thin liquidity because this market is jumping around.

The market is closing towards the bottom of the candlestick for the trading session, which typically means that there is a bit of continuation coming. We will eventually continue what we have been going through for some time. Volatility will continue to be one of the biggest issues, but eventually, people will start to pay attention to the supply and demand, meaning that I fully anticipate shorting this market sometime early next year.