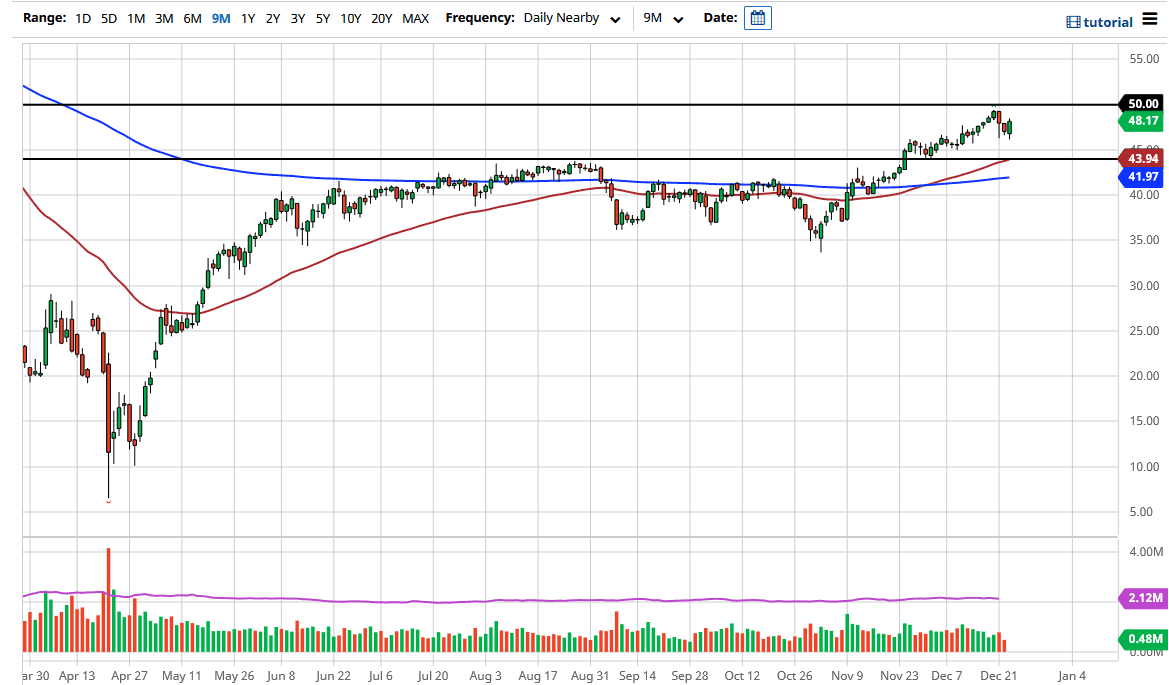

The West Texas Intermediate Crude Oil market had a strong session during the day on Wednesday, in what would have been very thin trading. After all, the market gapped lower to kick off the trading session, fell a bit, then turned around to show signs of life again. The market still looks as if it is probably going to go looking towards the $50 level above, which is a large, round, psychologically significant figure. The $50 level has recently seen some selling just below it, so that it makes a natural target for people to try to test.

If we could break above the $50 level, then it is likely that the market could squeeze higher, in a short-covering squeeze. At that point, the market would go looking towards the $52.50 level, perhaps even the $55 level. In the meantime, given that we are in the middle of the holidays, we will probably see more of a back-and-forth “buy on the dips” scenario. Whether or not crude oil markets can break out to the upside is a completely different question, but it is something for which we have to be prepared.

To the downside, I see a certain amount of support at the $44 level, perhaps extending to the $45 level. The 50-day EMA is touching the $44 level, which could offer more of a floor for this market. The stimulus coming out the United States will continue to lift the idea of commodities anyway, especially crude oil even though one has to wonder whether or not there is going to be enough demand to lift the markets for the longer term. I think this is more or less a short-term trade, with a potential pop down the road. Longer term, it remains to be seen if we can sustain this type of momentum, but that is a question for later. I like buying short-term dips, looking for short-term gains. Keep in mind that the markets will be open only about half the day as far as liquidity is concerned, so that is another thing to pay attention to as well. I have no interest in shorting, at least not yet.