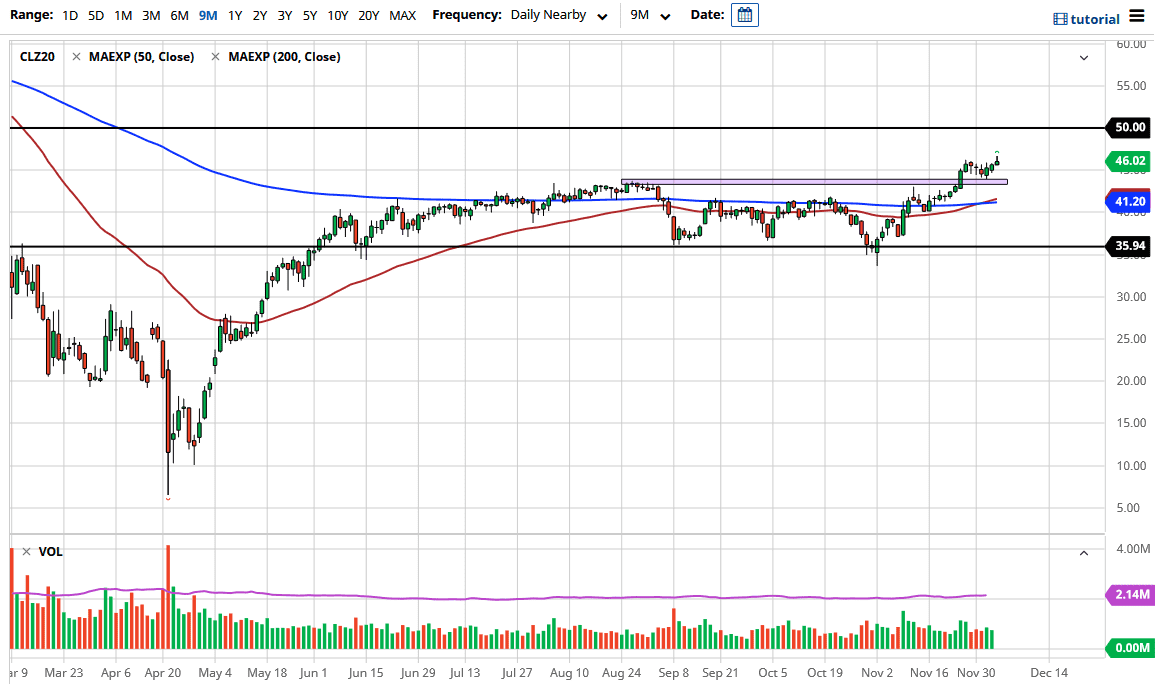

The West Texas Intermediate crude oil market continues to levitate just above the $46 level now that we have gotten the OPEC meeting out of the way. The shape of the candlestick is not exactly impressive, but there are plenty of buyers underneath to pick this market up on a pullback, as we have seen happen more than once. The US dollar continues to fall, which in turn continues to put a tailwind in the oil market as it makes commodities much cheaper.

Underneath, I see that many people will be paying attention to the $45 level as it is a large, round, psychologically significant figure, and now will attract a lot of “market memory” because we had broken out above it. If we break above the top of the shooting star, then the market will probably go looking towards the $50 level.

Even though the shooting star candlestick is a somewhat negative candlestick, I see far too much in the way of support underneath to think that the market would suddenly slice through it. Unless we see a major shift in attitude, this market is all but decided that it is going to the $50 level. The key here is going to be whether or not you can hang on to the choppy volatility that will happen between now and then. I do not think that we will get there overnight, but I do think that we will get there and that is probably the most important decision.

The 50-day EMA has broken above the 200-day EMA, which is a long-term “buy-and-hold signal”, although I would not necessarily play it that way. What we are seeing is the market trying to make a move towards that round figure of $50, and at that point we would have to take a look at the overall situation. Currently, I think it is going to be a stretch to get above $50, but it certainly looks as if a lot of the bullish traders out there will be hoping to at least make a test of it. It is not until we break down below the 200-day EMA underneath that I would consider shorting this market, something that does not look very likely, as it is down at the $41.20 level.