New COVID-19 infections continue to rise across South Africa, but the country reopened its border with Zimbabwe yesterday. Small- and medium-sized enterprises (SMEs) cheered the move, as many rely on cross-border trade with Zimbabwe. An officer with the South African Police Service (SAPS) confirmed they are ready to welcome Zimbabweans and their purchasing power. Following an advance, the USD/ZAR is on course for more downside below its support zone.

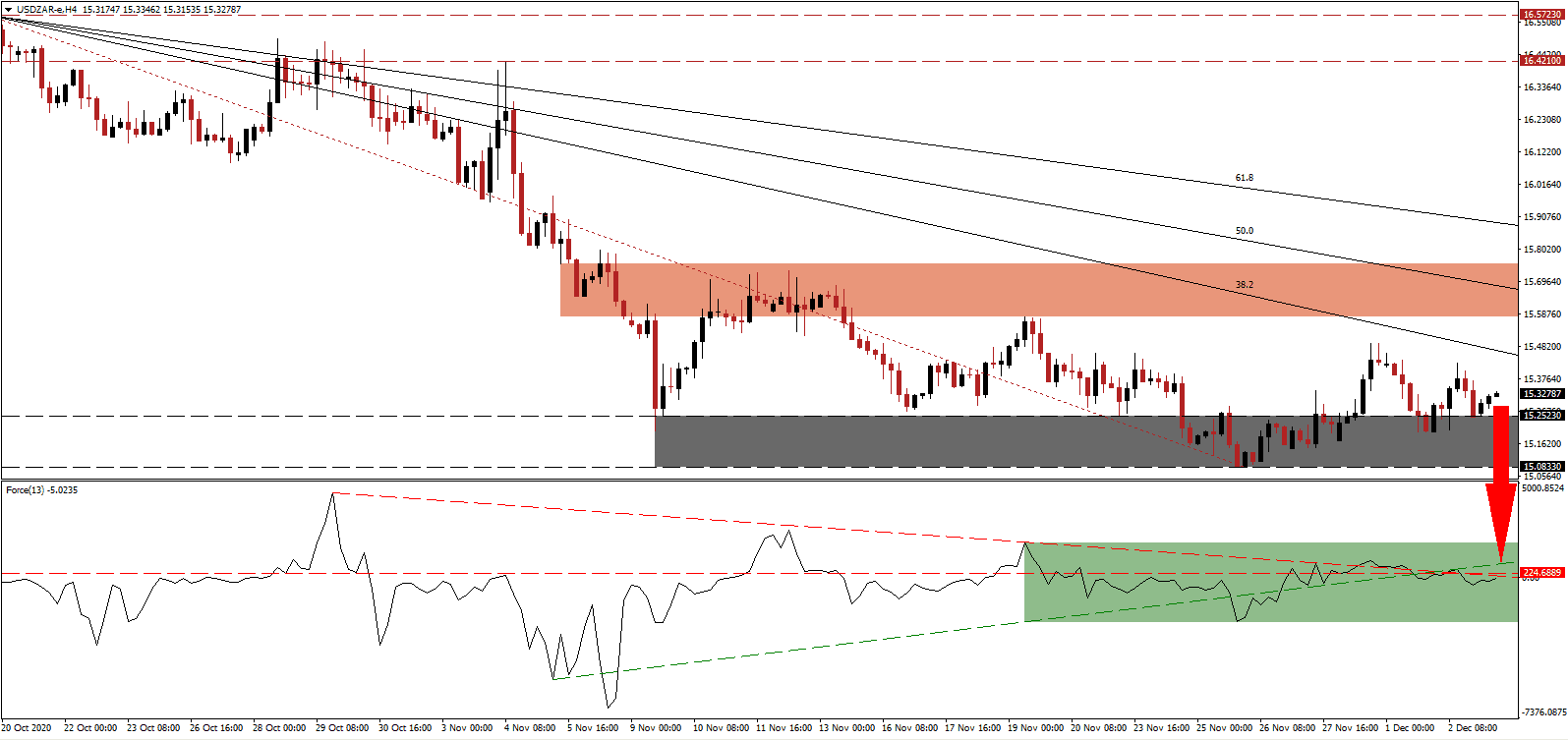

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, as marked by the green rectangle. Following the slide below its ascending support level, bearish momentum expanded, magnified by its descending resistance level. Bears are in complete control over the USD/ZAR with this technical indicator below the 0 center-line.

With new COVID-19 infections on the rise, the threat of localized lockdowns persists, which can derail the fragile recovery from a depressed base. The outlook for banks deteriorated amid the risk of loan defaults, and issues in the financial sector cloud the economic outlook. A pending downward revision to the short-term resistance zone, presently located between 15.5805 and 15.7539, as marked by the red rectangle, will add more breakdown pressures on the USD/ZAR.

Amid the financial hardship related to the pandemic, more South Africans tap their retirement savings. The short-term relief comes at a long-term cost, adding to future fiscal problems. The descending Fibonacci Retracement Fan sequence can force the USD/ZAR below its support zone between 15.0833 and 15.2523, as identified by the grey rectangle, and into its next one between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 15.3250

Take Profit @ 14.6000

Stop Loss @ 15.5250

Downside Potential: 7,250 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.63

A breakout in the Force Index above its ascending support level, serving as resistance, can push the USD/ZAR marginally higher. With the US crossing the 200,000 COVID-19 infection level per day, the outlook continues to collapse. The upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level, providing Forex traders with a secondary selling opportunity.

USD/ZAR Technical Trading Set-Up - Reduced Reversal Scenario

Long Entry @ 15.6500

Take Profit @ 15.8750

Stop Loss @ 15.5250

Upside Potential: 2,250 pips

Downside Risk: 1,250 pips

Risk/Reward Ratio: 1.80