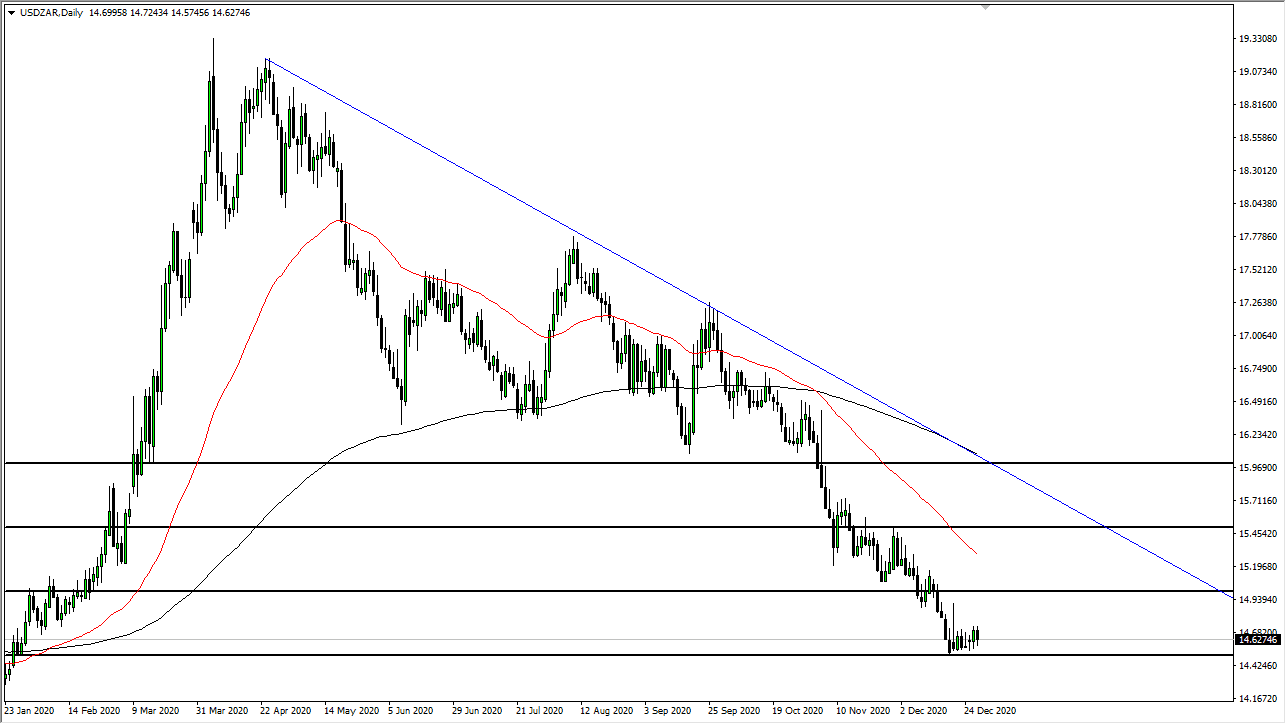

The US dollar fell during the trading session on Wednesday to reach down towards the 14.50 rand level yet again. At this point, the market is likely to continue seeing downward pressure, but it is worth noting that we are at extreme lows. Therefore, at the very least, we will probably continue to see selling pressure, but could very well see a bit of a bounce that people will use to their advantage. Keep in mind that it is very late in the year, so liquidity could be a major issue and rallies would be looked at with extreme suspicion. In fact, it could simply be a bit of profit-taking.

To the upside, I see the 15.00 level as significant resistance, just as the 50-day EMA sits above there and is racing lower. Sellers will eventually come back in based upon the fact that stimulus is so strong in the United States, and it should send money looking for other ways to get to work. The South African rand is a great way to play emerging markets, but it is also worth paying attention to the fact that it is a high-yielding currency, one of the few out there.

The 14.50 rand level underneath is supportive, so if we were to break down below there it is likely that we could go down to the 14 rand level. This is a market that is very negative and in a strong downtrend, so the only thing I am not looking to do here is to start buying. The downtrend line on the chart extends all the way to the 16 rand level, so it is going to take quite a bit to turn things around for a bigger move.

With the lack of volume at the end of the year and the potential for profit-taking, we will continue to see downward momentum going into next year. In the meantime, we are going to kill time or perhaps give back some of the gains in the rand simply to set things up for the continued move once we get into the month of January. Stimulus should continue to drive the value of the US dollar lower overall.