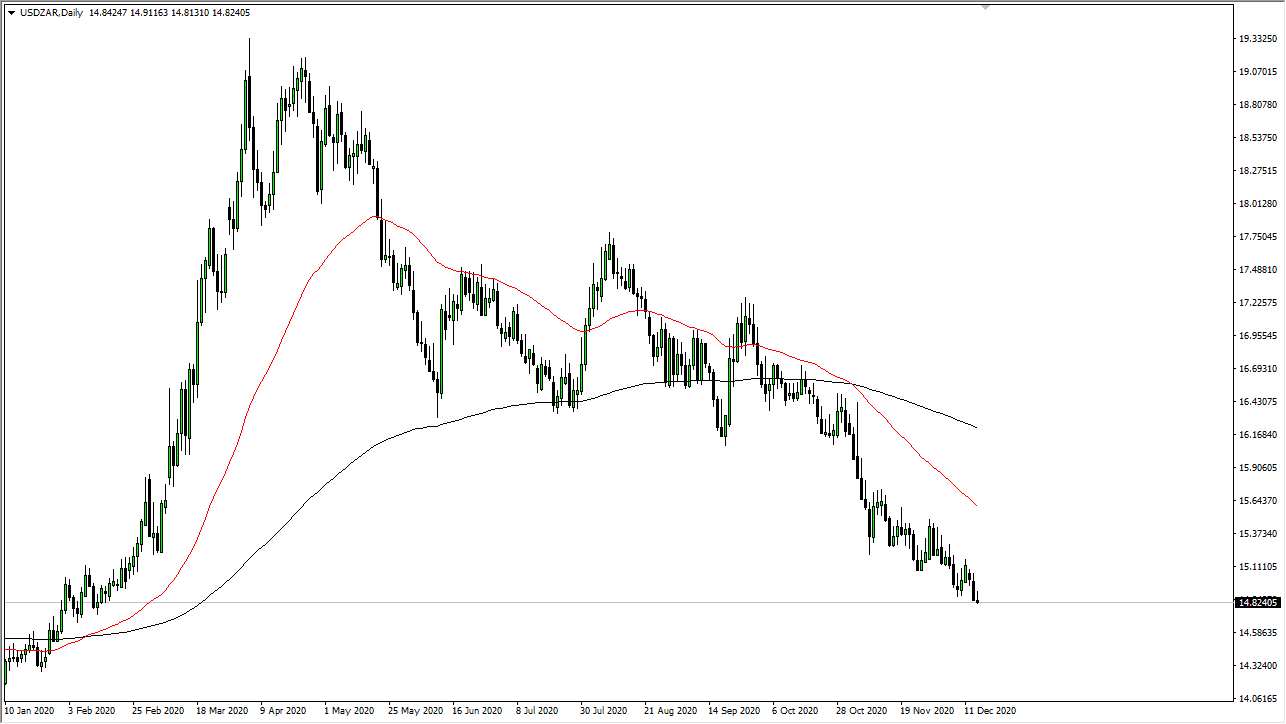

The US dollar rallied during the trading session on Wednesday, but then turned around by the end of the day after the Federal Reserve announcement. Now that we have gotten past that and are closing down at the bottom of the candlestick, it suggests that we have more momentum in the strengthening of the South African rand more than anything else. After all, if there is going to be a lot of stimulus out there, it is likely that we will continue to see commodity currencies become one of the biggest beneficiaries.

It appears that short-term rallies should be selling opportunities, and the 50-day EMA is starting to reach to much lower levels as well. The 14 rand level will offer a lot of support, including psychological support, so do not be surprised to see this market stall in that area. Just above, the 15.50 rand level could cause significant resistance. The 50-day EMA that I had laid out is sitting just above there.

If gold continues to rally, that is partially influential for the rand as well because the trend is firmly ensconced and it looks like the US dollar will continue to be very belabored. The candlestick for the trading session was an inverted hammer, which suggests that we could continue to go much lower given enough time. The market continues to be one that has been like a freight train going in the same direction, so it is difficult to make an argument for trying to reverse it anytime soon. However, if we get a major shock when it comes to the stimulus package, that could turn things around as people will be running towards the greenback. That seems to be very unlikely, so the market will continue to offer plenty of value any time we rally, due to the fact that the South African rand has seen so much in the way of momentum. One thing that you do have to keep in mind, though, is that we are very late in the rally, so it is difficult to get too big in my positioning.