South Africa is considering implementing snap lockdowns for areas where the second wave of COVID-19 infections threatens to collapse the healthcare system. The Bureau for Economic Research (BER) at the University of Stellenbosch warned the government against mini-lockdowns, citing negative impacts for the economy. While the seven-day infection average surpassed 2,900, compared to 1,500 one month ago, it is off the 12,000+ during the previous peak. The faltering breakout in the USD/ZAR positioned it for more downside.

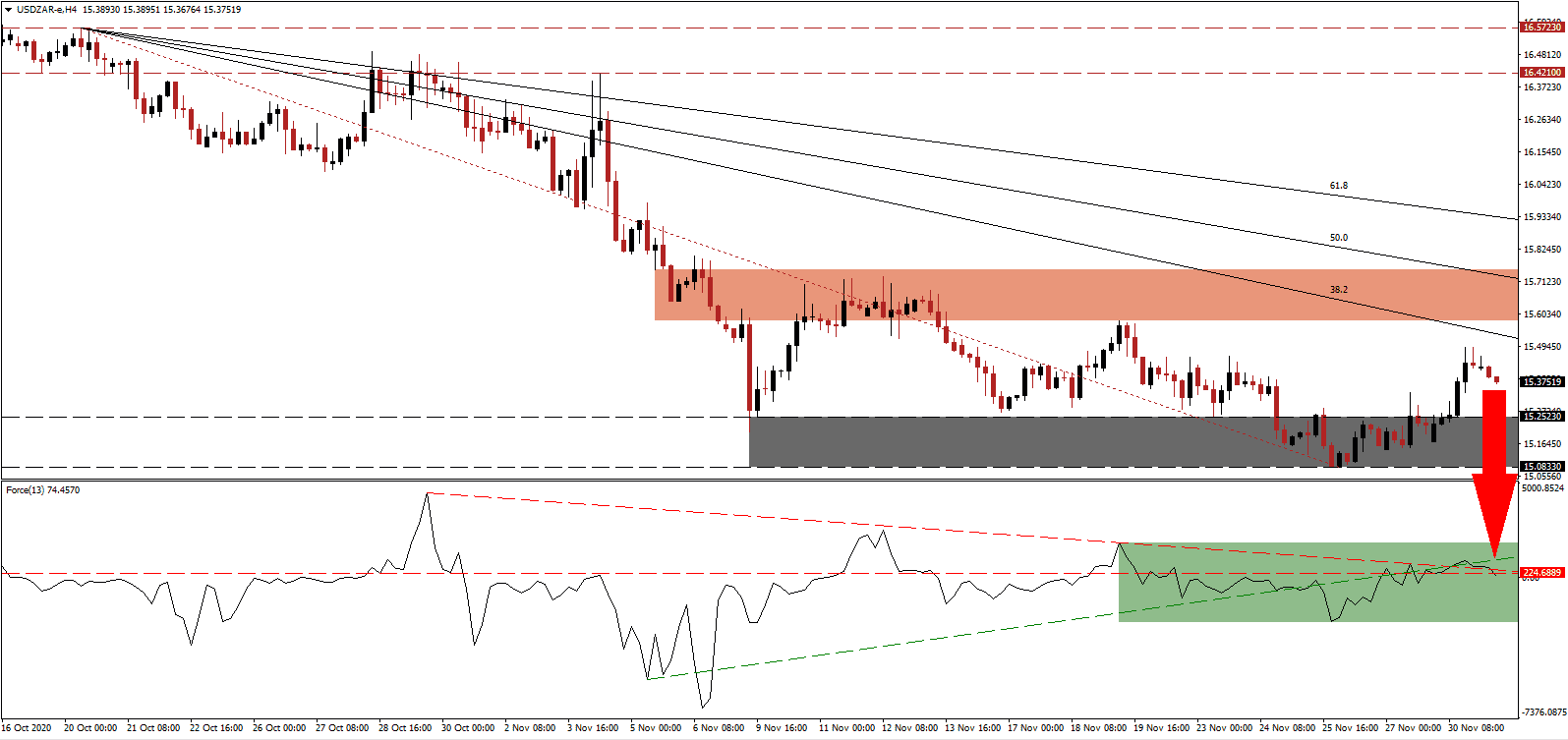

The Force Index, a next-generation technical indicator, moved below its horizontal resistance level following the rejection by its ascending support level. Bearish momentum expanded after the contraction through its descending resistance level, as marked by the green rectangle. With this technical indicator below the 0 center-line, bears remain in complete control over the USD/ZAR.

Following two downgrades with a negative outlook over South African debt, pressure on the government of Cyril Ramaphosa to implement business-friendly legislation increased. The third South African Investment Conference (SAIC) failed to duplicate the success of the previous two. The USD/ZAR recorded its third lower high and was unable to reach its short-term resistance zone located between 15.5805 and 15.7539, as identified by the red rectangle, confirming the dominance of bearish pressures, enhanced by the descending Fibonacci Retracement Fan sequence.

Thulas Nxesi, the Minister of Employment and Labour, cautioned that the Unemployment Insurance Fund (UIF) would collapse if it has to support employees who lost income due to the COVID-19 pandemic. While the government committed R40 billion, expenses to-date total R53 billion. The USD/ZAR remains positioned to correct through its support zone between 15.0833 and 15.2523, as marked by the grey rectangle. Price action will face the next one, located between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 15.3750

Take Profit @ 14.6000

Stop Loss @ 15.6000

Downside Potential: 7,750 pips

Upside Risk: 2,250 pips

Risk/Reward Ratio: 3.44

Should the Force Index push above its ascending support level serving as resistance, the USD/ZAR could attempt a second reversal. Given the intensifying bearish pressures on the US dollar, the upside potential remains confined to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders should consider any advance a secondary selling opportunity.

USD/ZAR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 15.7000

Take Profit @ 15.9000

Stop Loss @ 15.6000

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00