Amid the COVID-19 pandemic, the World Economic Forum (WEF) confirmed that the 2021 forum has been moved to Singapore. The Southeast Asian country maintains control over the pandemic with few active cases, and conditions allow an already delayed event to assemble under strict measures. The USD/SGD reverses a breakout above its support zone, and selling pressure continues to accumulate.

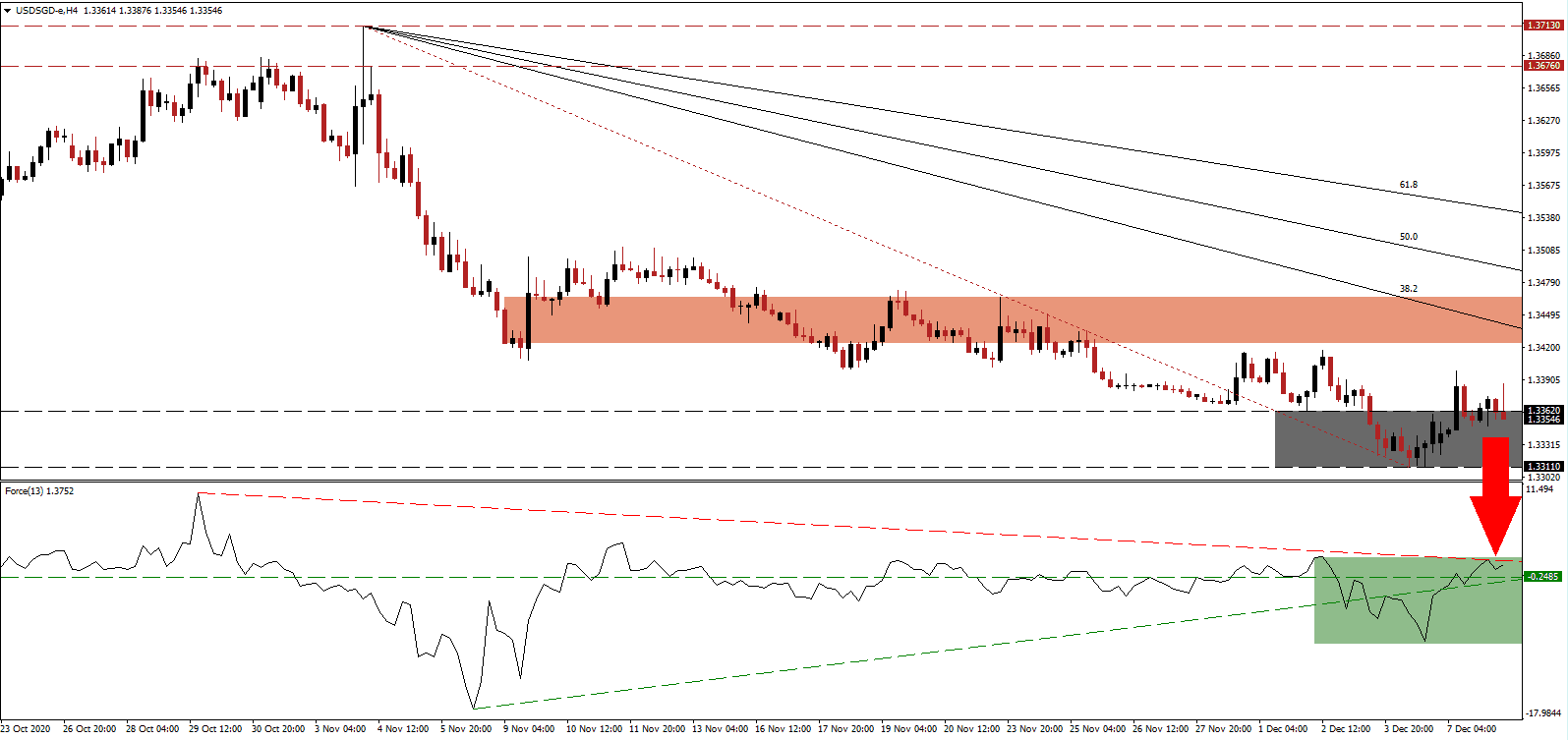

The Force Index, a next-generation technical indicator, confirmed the breakout but stalled at a previous peak, as marked by the green rectangle. Bullish momentum is weakening, and the adjusted descending resistance level can pressure the Force Index below its horizontal support level and through its ascending support level into negative territory. Bears will regain complete control over the USD/SGD following a move below the 0 center-line.

October retail sales dropped 8.6%, per data from the Singapore Department of Statistics (SingStat). Despite the dismal report, it marks an improvement over the 10.7% plunge reported in September. The breakdown in the USD/SGD below its short-term resistance zone located between 1.3424 and 1.3466, as marked by the red rectangle, intensified bearish pressures.

While the November manufacturing PMI eased to 50.4, it marked the fifth consecutive month of expansion with a reading above 50.0. Singapore remains in a superior economic position for 2021 compared to most countries. A breakdown in the USD/SGD below its support zone between 1.3311 and 1.3362, as identified by the grey rectangle, can take it into its next one located between 1.3213 and 1.3285. The descending Fibonacci Retracement Fan enforces the bearish chart pattern.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3355

Take Profit @ 1.3215

Stop Loss @ 1.3385

Downside Potential: 140 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 4.67

Should the Force Index push above its descending resistance level, the USD/SGD could attempt another breakout. Given the worsening conditions in the US, the upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level. Forex traders should view it as a selling opportunity.

USD/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.3420

Take Profit @ 1.3475

Stop Loss @ 1.3385

Upside Potential: 55 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 1.57