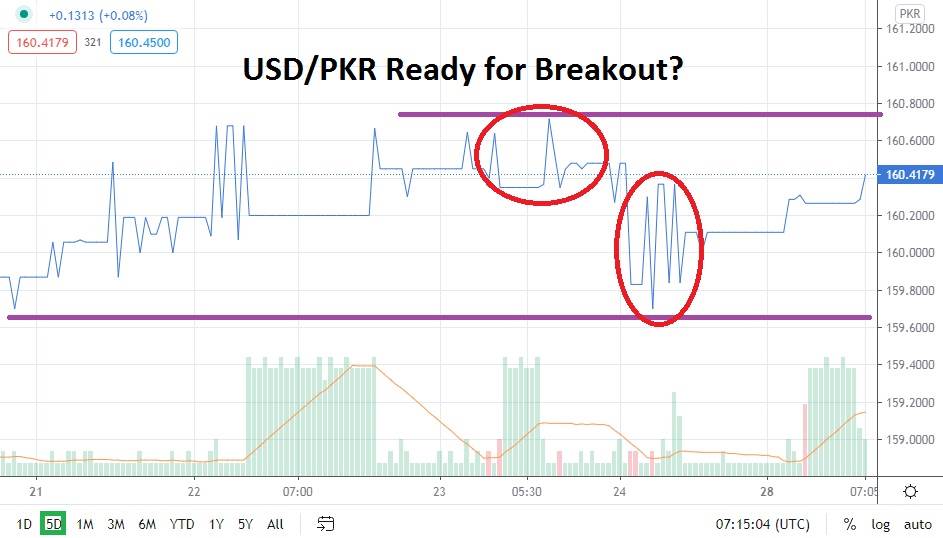

A tight range has emerged in the often volatile USD/PKR as support and resistance levels have proven rather strong. However, speculators of the Forex pair understand that quiet trading in the USD/PKR often does not last and volatility may not be far behind. The last week of trading has seen known values prove adequate as highs and lows, but interestingly, a lower support level was touched recently which may indicate that current support and resistance levels may begin to prove vulnerable.

After reaching a low of nearly 157.7000 in the middle of November, the USD/PKR has endured a slight bullish trend. However, the power of the higher momentum has not been devastatingly strong and has actually seen rather choppy values within a fairly consistent range. On the 24th of November, the USD/PKR reached the apex of a strong reversal from its lowest depths and approached the 161.0000 mark up above. Since reaching this height, the USD/PKR has begun to create a rather consolidated value band.

Some technical traders may believe that the USD/PKR needs to retest the 161.0000 mark again before it sees a stronger reversal lower, which will rejuvenate its bearish momentum that it has demonstrated since the end of August. However, if the bearish trend is in fact still dominant, perhaps the recent test of 160.7000 as resistance has proven that the USD/PKR doesn’t have much further to advance higher and is actually beginning to indicate that a breakout could occur with downside action.

Speculators should watch support levels carefully. If the 160.2000 to 160.1000 levels below are hit and value is sustained below the 160.0000 juncture and can hold this vicinity, it may signal that a test of 159.7000 could develop. The 159.7000 mark is a key inflection point for the USD/PKR and, if it is broken lower, traders may target the 159.5000 to 159.1000 values seen earlier in December.

The USD/PKR does not trade with a great amount of transparency, but global risk appetite may continue to demonstrate that it is rather steady and confident near term. If international markets prove stable, the USD/PKR may remain a potential Forex pair to speculate with and seek bearish momentum with selling positions.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.7000

- Current Support: 160.1000

- High Target: 161.1000

- Low Target: 159.7000