The USD/MXN continues to flaunt its long-term bearish trend and is challenging price levels not seen since March of 2020. Support levels are being tested regularly and, intriguingly, the USD/MXN has shown it has the ability to sustain its value below the important mark of 20.0000. Holiday trading volumes will be light near term and traders will have to watch out for sudden volatility in what otherwise may prove to be a rather quiet Forex market.

However, the ability of the USD/MXN to maintain its current price action and demonstrate that its bearish trend remains constant during the holiday season may be a signal of things to come. Global risk appetite is steady and the USD/MXN has clearly demonstrated that it is a barometer of investor sentiment on a regular basis. In March of 2020, the USD/MXN touched the 25.40000 juncture and has been able to incrementally recover stronger values for the Mexican peso since then.

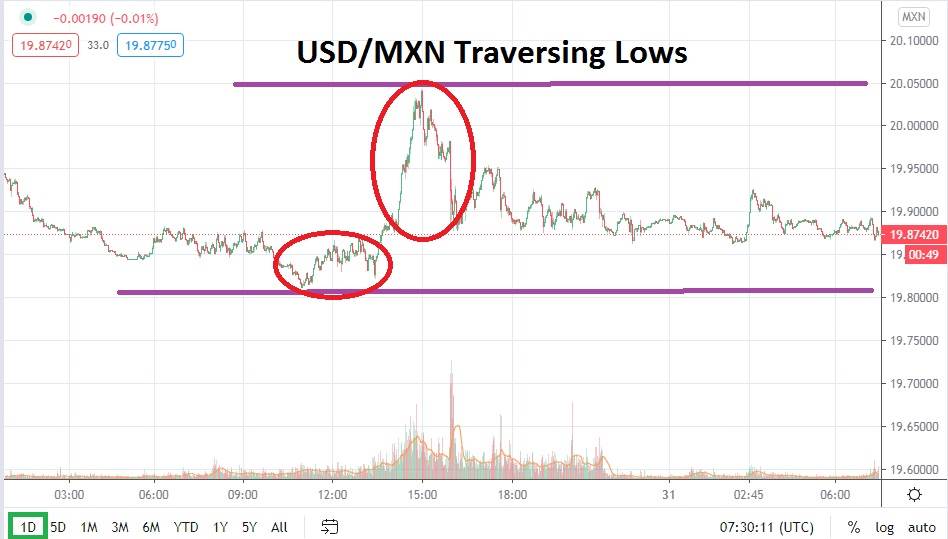

If the USD/MXN can muster enough bearish momentum and sustain its values beneath the important psychological level of 20.00000 near term, speculative interest in the Forex pair may grow. A vital inflection level below lurks at the 19.62000 support level. If the USD/MXN can challenge support marks of 19.83000 and 19.73000, it might begin to spark programmed trading within investment houses who know that the 19.62000 was traded in late February and appears to have been a pivotal point for the Forex pair as coronavirus concerns began to effect finance.

Trading within the USD/MXN has certainly seen a solid bearish trend, but reversals higher remain a factor and constant threat. There are no one-way streets for speculators to practice their trading craft, and risk management must always be used. Risk-takers, however, can use properly placed stop losses to protect their speculative wagers if they choose to pursue further downside momentum.

Resistance levels have shown a tendency to incrementally lower short term, but light holiday trading could make these marks rather vulnerable during the holiday season. However, traders who do decide to participate in the USD/MXN short term should continue to consider being sellers and pursue the downside momentum the pair has clearly demonstrated.

Mexican Peso Short-Term Outlook:

- Current Resistance: 19.96000

- Current Support: 19.83000

- High Target: 20.07000

- Low Target: 19.73000