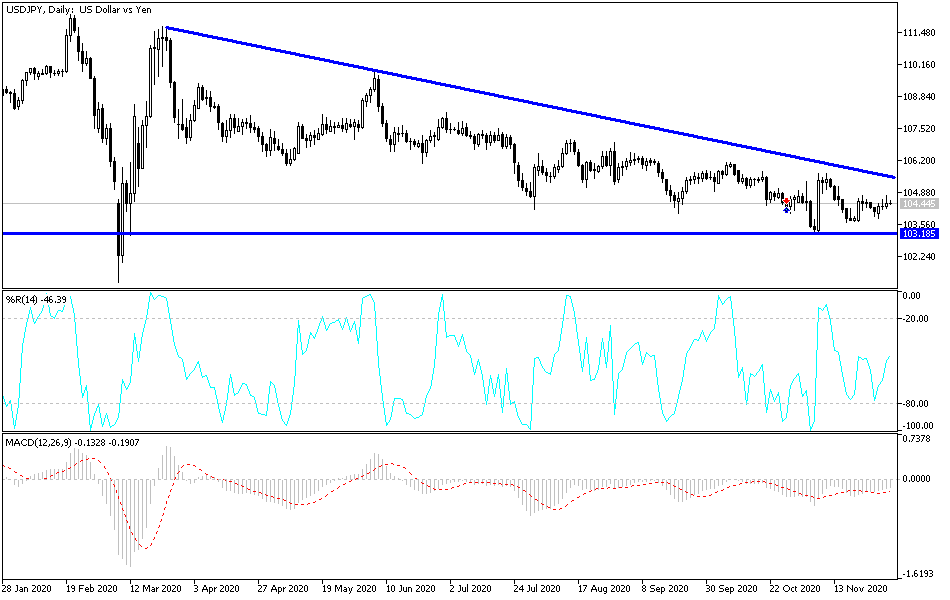

News surrounding coronavirus vaccines and President Trump's transition initiation caused losses to the safe haven USD. One of those losses was the USD/JPY's drop to the 103.18 support, its lowest level since last March. Since the beginning of trading this week, the pair tried to rebound higher, but gains did not exceed the 104.75 level and stabilized around the 104.45 level at the time of writing.

Biden began to identify the names of his White House administration team, the most prominent of which were on the Obama team. In his last comments on the tariffs imposed by Trump, Joe Biden said he would not immediately lift tariffs that President Donald Trump imposed on many imports from China or break Trump's initial trade deals.

Speaking to Thomas Friedman, columnist for the New York Times, Biden said, "I will not take any immediate steps, and the same goes for the tariffs. I will not break my choices."

Under Trump, the United States and China have been involved in a year-long trade war that has been largely frozen since the Phase 1 agreement was reached in January 2020. While some industries have benefited from Trump's protectionist policies, the policies have been largely directed by the business community and US companies and consumers bore most of the tariffs. Biden told Friedman that one of his first priorities after he is sworn in in January would be to restore relations with the allies to strengthen his negotiating position with China. In this regard, Biden said that the key to talks with China is "influence" and, in his opinion, "we do not have that yet."

Regarding coronavirus vaccines, which have recently sparked optimism in the financial markets, Britain has become the first country in the world to authorize a rigorously tested COVID-19 vaccine and can distribute vaccines within days. This is a historic step towards ending the disaster that has claimed more than 1.4 million lives around the world. By giving the green light to the emergency use of a vaccine developed by the American pharmaceutical company Pfizer and Germany's BioNTech, Britain has bypassed the United States by at least a week. The US Food and Drug Administration is not due to consider the vaccine until December 10.

Commenting on this, British Health Minister Matt Hancock said: "This is a day that we will remember, frankly, in a year that will not be forgotten."

The announcement paves the way for the largest vaccination campaign in British history, and came before experts warn that it will be a long and dark winter, with coronavirus cases rising to epic levels in the United States and Europe and putting pressure on hospitals and companies. Accordingly, officials warned that there are still difficult months ahead even in Britain, given the sheer scale of the operation required to vaccinate large swaths of the population. Because of the limited initial supply, the first doses will be reserved for people most at risk - i.e. nursing home patients, the elderly, and healthcare workers.

Technical analysis of the pair:

There is no change in my technical view for the USD/JPY performance. As is evident on the daily chart, the general trend is still bearish, despite weak attempts to rebound upwards. A bullish reversal will happen as I mentioned before if the currency pair moves towards the resistance levels of 106.00 and 108.00, respectively. On the downside, moving below 104.00 support does not prevent the bears from moving towards stronger support levels.

In addition to the extent of investors’ risk appetite, the dollar will be affected today by the announcement of unemployment claims and the US services ISM PMI reading.