Stability around and below the 104.00 support level continues to fuel the survival of the USD/JPY in the range of a sharp downward channel. No real rebound will occur without an approved US stimulus plan and a return of confidence in the US dollar, which fell to its lowest in two-and-a-half years, as per the USDX. The pair did not completely benefit from the wave of risk appetite that swept global financial markets following positive coronavirus vaccine developments and distribution.

Productivity in the US increased at a strong pace of 4.6% in the July-September quarter, just below the initial estimate, while labour costs fell at a slower pace. The US Labour Department reported that the productivity increase in the third quarter was lower than the first estimate a month ago of a 4.9% increase. Productivity increased by 10.6% in the second quarter. Labour costs fell 6.6% in the third quarter, less than the 8.9% drop estimated a month earlier.

Productivity, the amount of production per hour worked, is the main determinant of living standards. With higher productivity, employers can pay their workers more without having to increase the prices of their products. The revisions reflected the fact that there was a downward revision of 0.1 percentage point in production and an upward revision of 0.3 percentage point in hours worked.

Economists have warned that fluctuations in productivity this year have been unusually large and distort the fundamental trend in productivity.

“The data was particularly volatile from a quarter to a quarter, reflecting the impact of COVID-19 on production, hours and compensation,” said Robella Farooqui, Senior US Economist at High Frequency Economics. “The underlying trend in productivity is likely to be moderate from the current pace in the coming quarters.”

The big increase in productivity occurred in the second quarter due to employers laying off millions of workers. The drop in workers was greater than the fall in production that occurred in the spring as a result of the widespread lockdown to try to contain the coronavirus. For the full year of 2019, US productivity rose by a modest 1.7% after weaker 1.4% gains in 2018. Productivity has lagged in recent years, and economists have cited this slowdown as one of the major problems facing the country, since slowing productivity growth has prevented living standards from rising at a faster pace.

The United States of America is still recording heavier human losses and record numbers of cases and deaths due to the pandemic, which will force the US administration to speed up licensing vaccines, as happened in the UK. US deaths from the coronavirus have increased to more than 2,200 daily on average, in proportion to the peak it reached last April. The number of cases per day surpassed an average of 200,000 for the first time ever, and the crisis is likely to get worse due to the fallout from gatherings over Thanksgiving, Christmas and New Year. Almost every state is reporting a surge in infections. The vaccine will appear days after obtaining the US health approval.

Coronavirus has caused more than 284,000 confirmed deaths and about 15 million confirmed cases in the United States of America. In a positive development of the global health crisis, the US Food and Drug Administration said that the Pfizer vaccine strongly protects against COVID-19 and appeared safe in the agency's initial review, paving the way for possible approval in the United States within days.

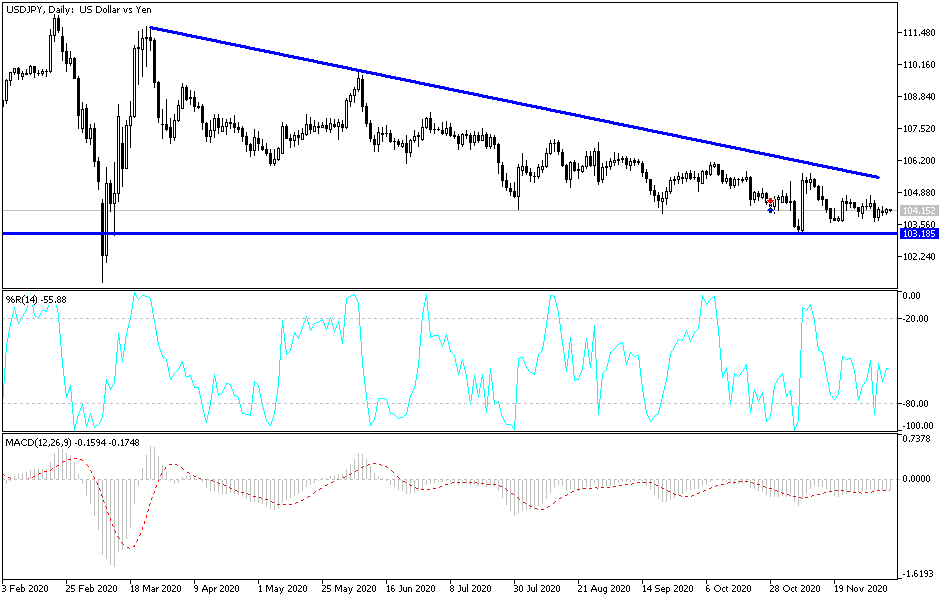

Technical analysis of the pair:

There is no change to my technical view of the USD/JPY performance. The general trend is still bearish, and stability below the 104.00 support threatens to move towards stronger support levels, the closest of which are currently at 103.75, 103.20 and 102.45, respectively. At the same time, these levels push technical indicators, as per the daily chart performance, towards strong, oversold levels. I still prefer to buy the pair from every drop. On the upside, we are waiting for the breach of the 106.00 resistance so that bulls will have a better chance to start controlling the performance.

The pair is not waiting for any important or influential data from Japan or the USA today.