Today and tomorrow are the most important days of this week for the remainder of 2020 trading, with the anticipation of the release of economic data. Therefore, the USD/JPY currency pair may witness a strong reaction to these results. So far, the currency pair's path is still bearish, and with the beginning of this week's trading, it only reached the resistance at 103.88. The pair's recent losses pushed it towards the support at 102.88, its lowest since last March. The pair showed no strong reaction to the long-awaited announcement to provide further stimulus to the US economy.

The $900 billion economic relief package passed by US Congress will provide vital assistance to millions of families and businesses who have struggled for months to survive. However, as the economy continues to fall into the grip of a pandemic that further tightens restrictions on business activity, more federal assistance is likely to be required soon.

It is unclear whether the new US government will provide that assistance or not.

For now, the package approved by Congress on Sunday will provide urgently needed benefits for the unemployed, loans to help small businesses stay open and up to $600 in cash payments for most individuals. It will also help families facing evictions to stay home. However, the measure does not include any budgetary assistance for states and local governments who are forced to resort to layoffs and cuts in services as their tax revenues dry up - a potential long-term hindrance to the US economy.

After this announcement, economists say that months from now, the widespread distribution and use of vaccines will likely lead to a strong economic recovery as the virus is wiped out, businesses reopen, employment resumes and consumers spend freely again. Until then, the limited aid approved by Congress will likely not be enough to stave off the hardships facing many families and small businesses, especially if lawmakers refrain from enacting more aid early next year. The widening financial gap between the affluent and the disadvantaged is likely to worsen.

“Some aid is better than nothing at all,” said Gregory Daco, Chief US Economist at Oxford Economics. "It's a positive thing, but it will probably not be sufficient to fill the gap from today until late spring or early summer, when the health condition completely improves.”

For his part, US President-Elect Joe Biden said he would seek another relief package shortly after his inauguration next month, sparking another political squabble, given that some Republicans in the Senate have said that with vaccines on the way, they believe more government aid may not be unnecessary.

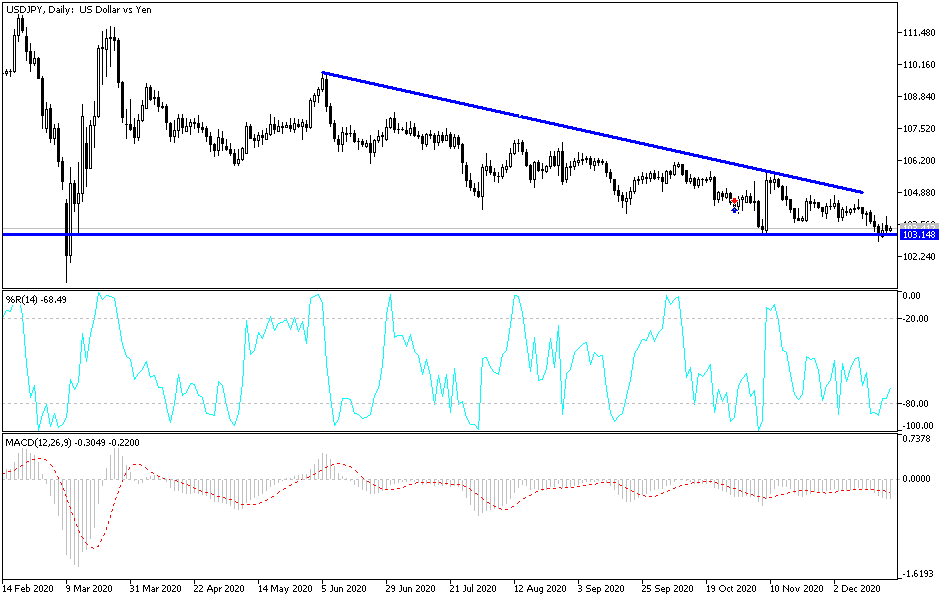

Technical analysis of the pair:

Coronavirus vaccines appeared and plans were approved to stimulate the US economy, and so far, the USD/JPY is still suffering from lack of incentives to break out of its sharp descending channel. As I mentioned before, there will be no technical opportunity for an initial change in this trend without the pair moving towards the 106.00 resistance. According to the current performance, stability around and below the 104.00 support will continue to motivate the bears to control the performance and thus prepare to test stronger support levels. The most important ones are currently 102.90, 102.00 and 101.25, respectively. At the same time, those levels push the technical indicators into strong oversold areas.

Forex traders are waiting for the opportunity to buy instead of preparing for further selling.

Today's economic calendar:

All focus will be on the results of the US economic data, which include the GDP growth rate, US Consumer Confidence Index and existing US home sales.