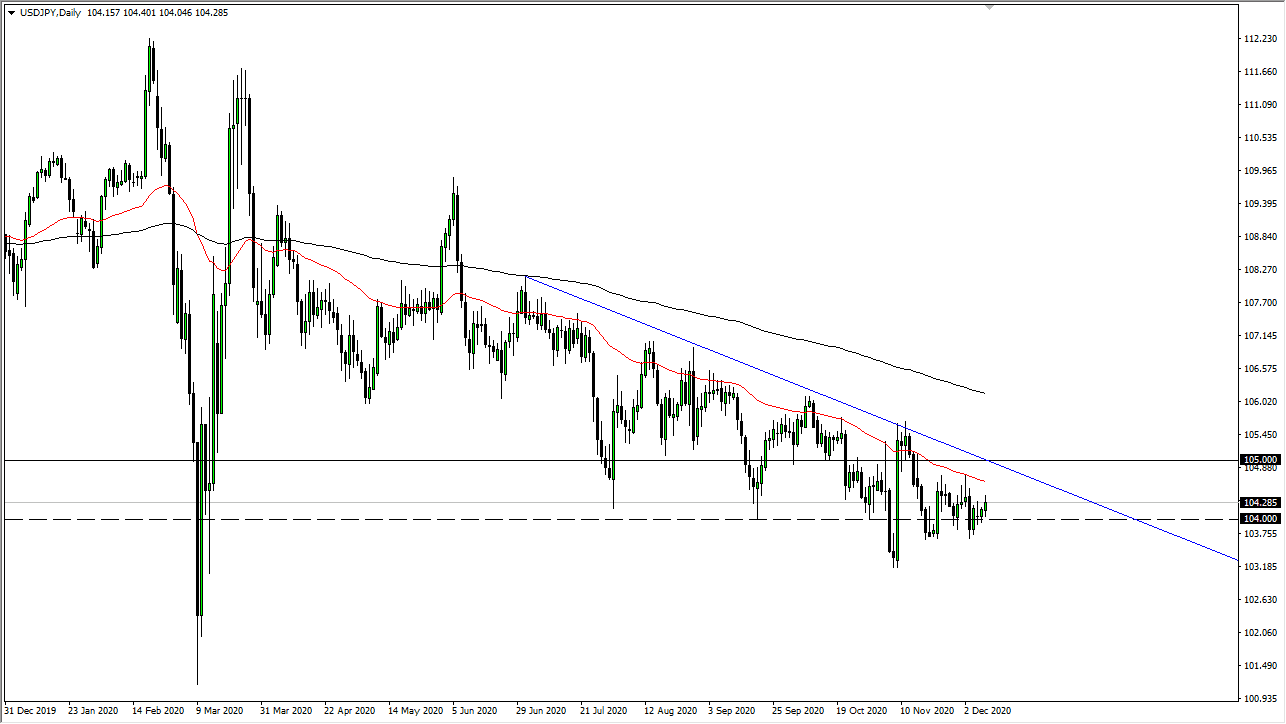

The US dollar continues to do very little against the Japanese yen, although the session on Wednesday was slightly positive. One of the things that you need to pay the most attention to is the fact that we are converging somewhere just above the ¥104 level. The market has been very noisy over the last couple of weeks, but really has not gotten anywhere. When you look at the longer-term chart though, that might be where the true attitude of the market shows itself.

We are clearly in a longer-term downtrend. The 50-day EMA above offers significant resistance and it should be noted that every time we have pierced the 50-day EMA for some time, we could not reach the 200-day EMA. That's why I consider that a massive “wall of resistance” that this pair has to try to take down. If and when it does, I would be impressed; but until then, this market is probably easier to sell than buying.

Keep in mind that there are a couple of different things going on at the same time in this market. Typically, if there is more of a “risk on” type of attitude, the US dollar will rise against the Japanese yen considering that the latter is one of the most favored “safety currencies” in the market. The US dollar is also considered to be a safety currency, but it is not as safe as the yen. People will sell off the Japanese yen and push this pair higher if equities are going higher at the same time. However, the Federal Reserve has massive quantitative easing going on and, at the same time, there is said to be fiscal stimulus coming out the United States. That should continue to put a weight around the neck of the greenback in general. We have seen the greenback give up strength against several currencies so far, so even though there is a bit of a “reflation trade” out there, the US dollar is hated enough that it is being reflected here as well. With this in mind, if we can break down below the ¥103.70 level, I think we will open up the door to the ¥103.25 level, followed by the ¥102 level. Those are all areas where we could see potential buying, and therefore support. Nonetheless, I prefer to fade rallies.