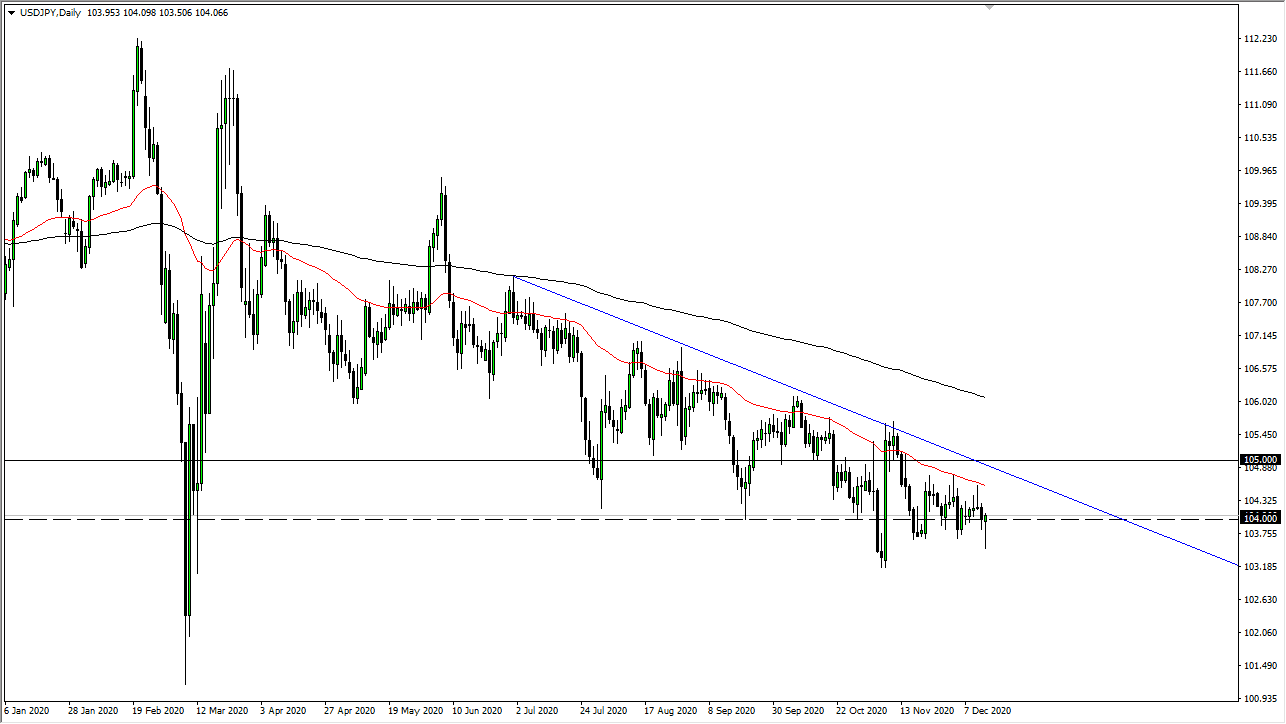

The US dollar initially fell a bit during the trading session on Monday to break down significantly through the ¥104 level, which is an area that has been massive support extending down to the ¥103.70 level. All of that area has been rather reliable over the last week or two, and the fact that we pierced that area is a very negative turn of events as it has taken so much to finally break through it. However, the markets have been in a downtrend for some time, so it should not be a big surprise that sellers made a serious play to break this pair down. By the end of the day, though, we have turned back around to break above the ¥104 level to form a hammer. That being said, I am still not a buyer of this pair.

Keep in mind that the pair continues to see a lot of resistance near the 50-day EMA, which is painted in red on the chart. Beyond that, there is also the downtrend line and the ¥105 level. If we do get a bounce from this candlestick - and it looks like we very well could - that should end up being a nice selling opportunity as it will offer “cheap yen.”

If we finally break down below the ¥103.70 level on a daily close, that opens up a move down to the ¥103.25 level, and then perhaps down below there to finally make a move towards the ¥102 level. There is a lot of choppy back-and-forth trading just waiting to happen, but looking at this chart, you can see that it has been very difficult to break this down. I think the problem here is that the pair is highly sensitive to risk appetite, and let's face it: risk appetite is most certainly a mainstay of the market when it comes to stocks and anything that is related to liquidity. You have to keep in mind that the stimulus of the US government will weigh upon the greenback, so it creates a “push/pull” type of dynamic for the market that will keep it very tight. You need to keep an eye on the longer-term trend, and it is most certainly negative at this point.