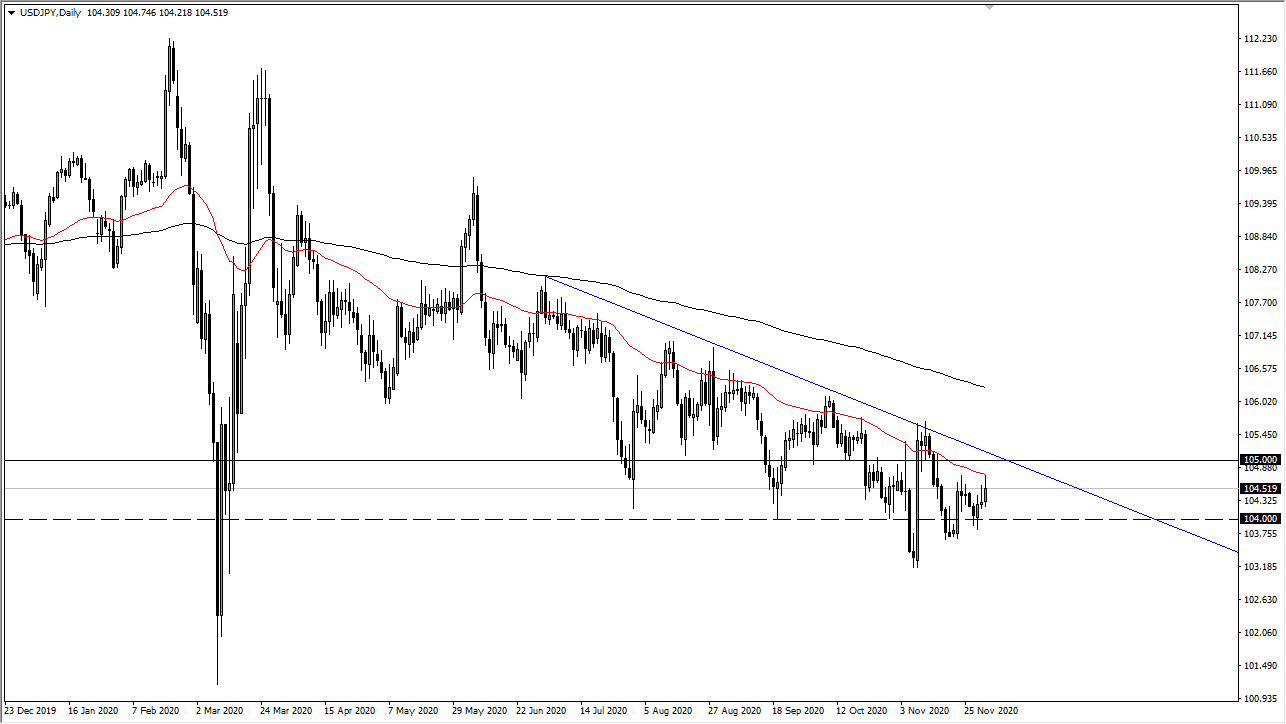

The US dollar rallied significantly during the trading session against the Japanese yen on Wednesday, but continues to find resistance near the 50-day EMA. The market is likely to hear a lot of noise in this area, so we will continue to start shorting this market above the 50-day EMA and below the ¥105 level, perhaps even the downtrend line that extends further.

The market will continue to find sellers every time it rallies, because the Federal Reserve is out there trying to do what it can to bring down the value of the greenback. Furthermore, if we get a “risk-off” type of event, we could see the market reaching towards the Japanese yen. However, one thing that you should keep in mind is that the lows have gotten higher as of late, which suggests that there is a bit of confusion. The market is forming a symmetrical triangle, so anticipate a lot of volatility going forward. The fact that the Non-Farm Payroll announcement will be during the Friday session will certainly not do much to calm the situation down. as this pair tends to be very sensitive to that announcement.

While not quite a shooting star, the candlestick for the trading session on Wednesday shows that it is going to be difficult to continue going higher. I believe the ¥104 level underneath would be a target, and if we can break down below there, then the market is likely to go looking towards the ¥103.25 level. I do not have any scenario in which I'm willing to buy this pair, because if we suddenly got a massive rush into the US dollar, it would probably have a lot to do with fear. Therefore, I would be much more apt to short the AUD/USD pair instead of trying to buy USD/JPY, as it would essentially accomplish the same “risk-off” type of trade. We are in a downtrend and you should not try to fight longer-term trends.