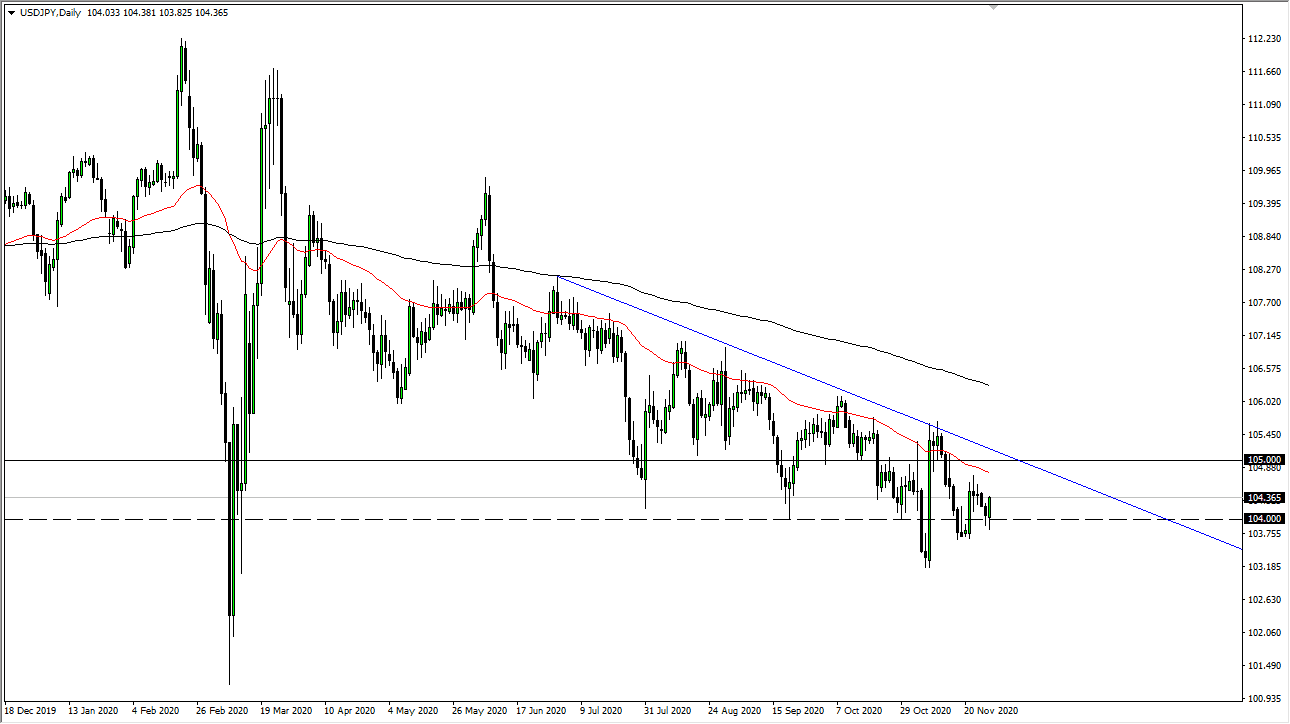

The US dollar initially fell during the trading session on Monday, breaking below the ¥104 level before turning around to rally rather significantly. However, we are very much in a downtrend, and the 50-day EMA above should continue to be a major problem. What we are looking at here is the possibility of the market simply reaching towards the 50-day EMA before finding sellers again. If it does find sellers out there, then we will likely break towards the bottom of the range for the session on Monday.

At this point, we are trying to form a symmetric triangle - meaning that the market does not really know what to do. The US dollar has been oversold for a while, so this should not be a huge surprise. Nonetheless, the trend is still very much to the downside, and the fundamentals certainly do not favor the greenback over the Japanese yen or many other currencies at this point. Fading rallies continues to work, but this was an extraordinarily strong move by the dollar during the day. Is the trend changing? Absolutely not. It was probably overdue for some profit-taking in other currencies, and it did have a little bit of a “knock on" effect over here.

You are looking at a short-term back-and-forth type of situation on which it will be difficult to put a lot of money. This is a market that continues to get thrown around based on the latest risk appetite headline and lack of clarity when it comes to all things financially related. With that in mind, it is probably best to simply wait for buyers to step in and lose a little bit of ground before shorting. Longer term, the market will probably go looking towards the ¥102 level, and with the massive amount of resistance that we have seen just above the 50-day EMA, I cannot make an argument for buying this pair anytime soon. The currency markets are going to get messier, not anything close to being clear.