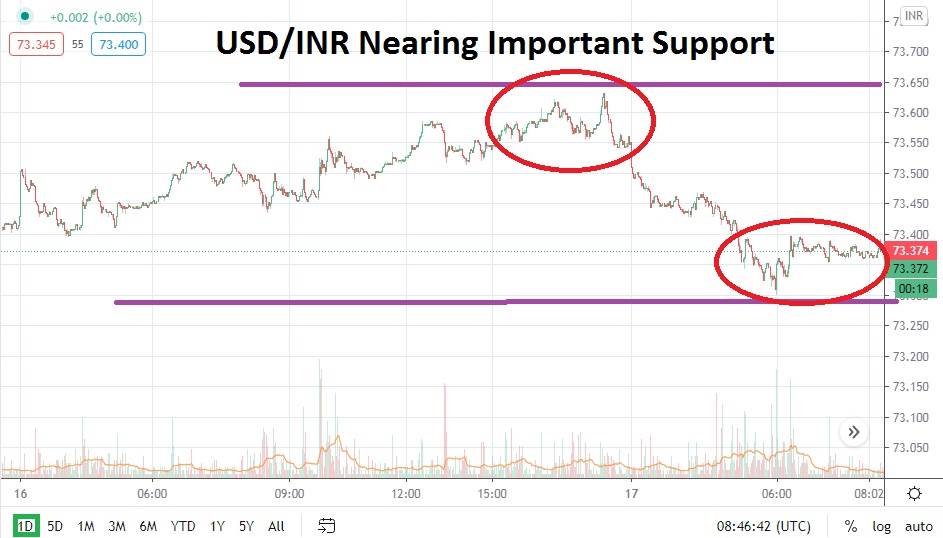

The USD/INR has demonstrated an ability to continue its bearish trend this week and has been able to sustain its lower values. Important support levels are now coming into focus for the Forex pair which have not been genuinely tested since October. If the USD/INR can prove that support near the 73.350 level is vulnerable, speculators may believe that additional downward tests may emerge near term.

As of this morning, the USD/INR is near the 73.400 mark, and if the Forex pair can maintain its current stance, there is evidence developing from a technical perspective that values could produce more bearish momentum. Speculators should be aware that the USD/INR can exhibit sudden spikes; violent moves upwards are not unheard. However, current Forex conditions, while taking into consideration the rather sizeable amount of global risk appetite, suggest that support levels may prove vulnerable near term.

The 73.310 support level should be watched carefully; if this juncture is approached, it could set off alarm bells for speculators. The USD/INR has challenged these lower levels in the recent past; from August through October, the Forex pair witnessed a price range approximately between 72.850 and 73.900. The USD/INR does have the capability to trade lower, but the junctures mentioned should also indicate that moves upward are not out of the question.

The decision speculators will have to make is if there is enough bearish sentiment within the USD/INR to cause further downside movement. If traders want to pursue selling positions, they can use resistance levels which are fairly close to current prices as stop losses to test the waters. Speculators may want to wait for the USD/INR to prove it can sustain values below the 73.430 level for a while before wagering on further downside movement.

Traders should be prepared for fast market conditions over the next two days of trading. Many financial institutions may be positioning themselves for the holiday season about to happen across the globe, which will decrease trading volumes next week. This will leave the door open to the potential for volatility from the USD/INR. However, traders with speculative notions may want to continue pursuing bearish price action with the belief that support levels within the Forex pair may prove vulnerable.

Indian Rupee Short-Term Outlook:

- Current Resistance: 73.480

- Current Support: 73.310

- High Target: 73.720

- Low Target: 73.210