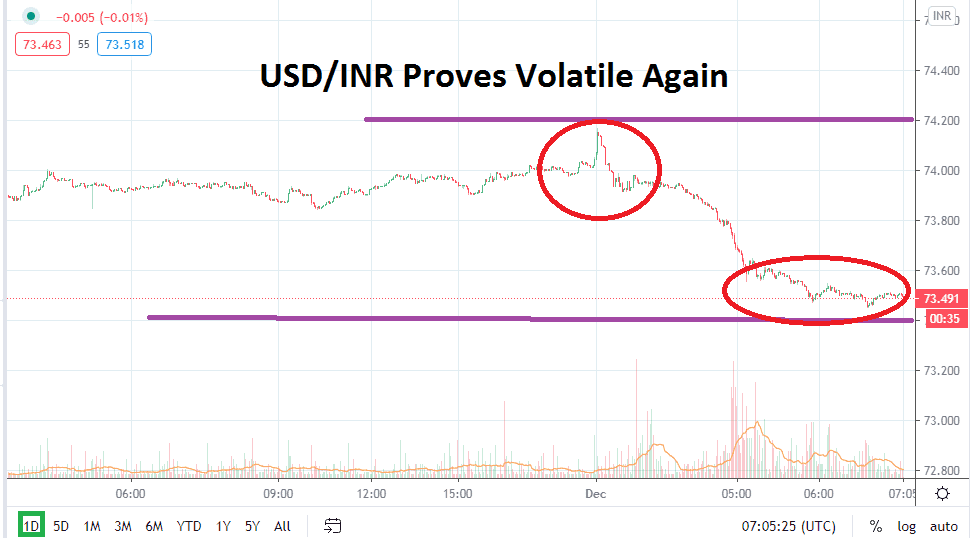

Trading in the USD/INR has been fast this morning and it may continue short term. The Indian rupee had shown the ability to sustain its value below the 74.000 juncture the past few trading sessions. However, the USD/INR experienced a violent spike higher this morning, nearly touching the 74.200 level, but promptly witnessed a dramatic spike lower. Trading as of this writing is within the 73.500 vicinity.

The current price of the USD/INR will catch the eye of speculators because the Forex pair is now testing values last seen on the 23rd of October. The last week of October proved to be difficult for bearish traders within the USD/INR as the pair started to see a strong upwards trend develop. The question speculators would like to see answered is if the sudden downwards movement this morning is going to firmly reestablish a value range for the USD/INR, which was largely tested in September and October, or if the Forex pair will see additional spikes ignite.

Volatility has not been rampant in the USD/INR lately, but the trading today is a reminder for speculators of the Forex pair that risk management is a wise tool to be using at all times. What may prove intriguing for traders is the notion that the swift move upwards this morning saw an immediate counterattack lower. The 74.000 level was punctured momentarily, but the burst above the important inflection point was not sustained; in fact, it failed, and the USD/INR is now at a one-month low.

The USD/INR should be treated carefully short term. The Forex pair has demonstrated what can be called a bearish trend since the 12th of November. If the Indian rupee can sustain its value below resistance levels of 73.680, this may encourage technical traders to look for further downside traction and a potential test of October values when the USD/INR predominantly traded between 73.000 and 73.650.

However, after this morning’s quick shock to the system via two extreme spikes in different directions, traders should remain suspicious of the USD/INR. There may be large government and institutional transactions taking place which caused the rapid fluctuations because it is the first of December and payments have to be made, but this is only a guess. From a technical perspective, it may prove logical to continue to pursue bearish sentiment with the USD/INR, but tranquil trading conditions will be welcomed first.

Indian Rupee Short-Term Outlook:

- Current Resistance: 73.680

- Current Support: 73.360

- High Target: 74.010

- Low Target: 73.210