Despite the first-ever recession in India since record-keeping began, triggered by the global COVID-19 pandemic, foreign direct investment (FDI) increased by 15.0% between April and September to $39.9 billion. It indicates more demand moving forward as India attempts to offer an alternative to China. The breakdown in the USD/INR below its short-term resistance zone can lead to a more massive correction.

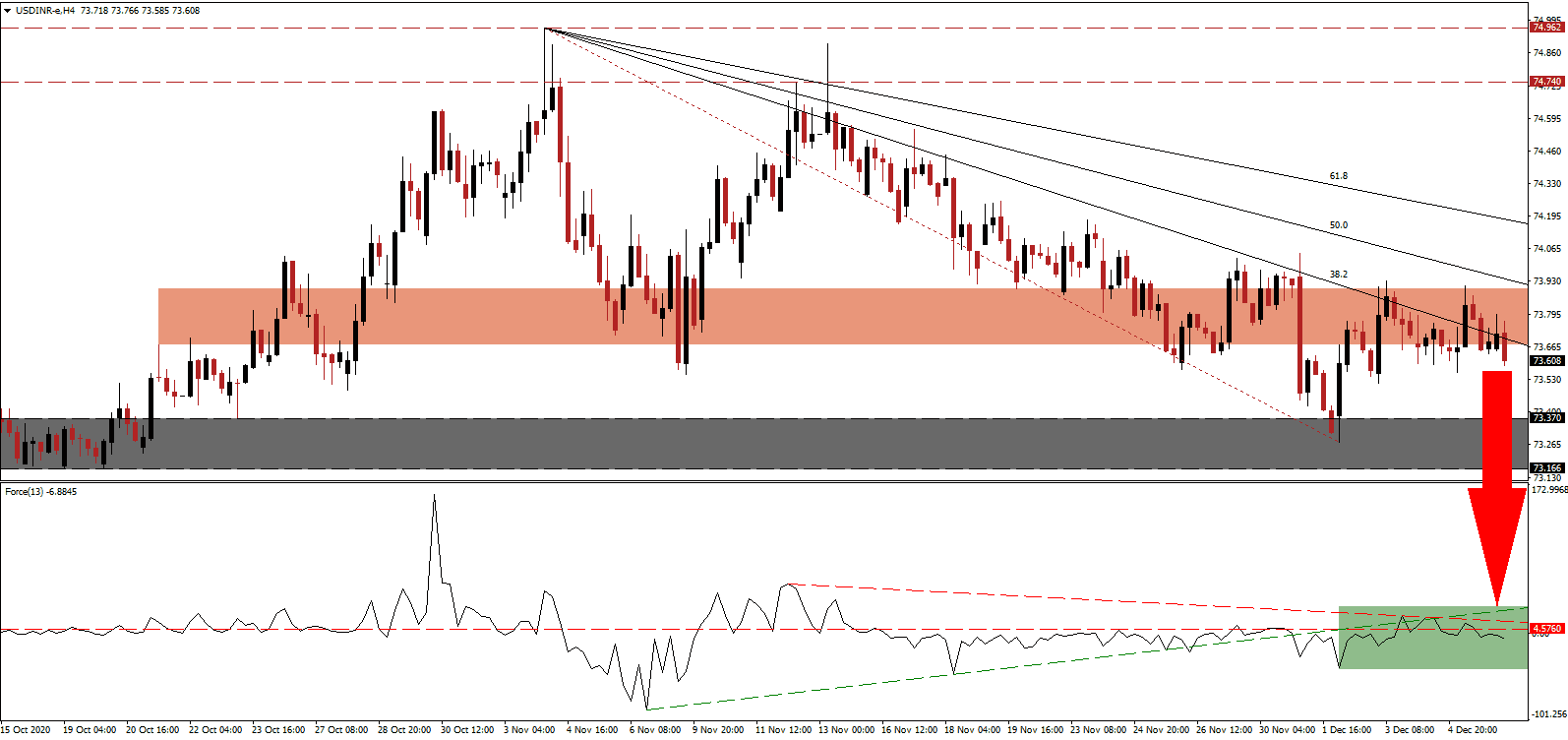

The Force Index, a next-generation technical indicator, faces rising bearish momentum following the move below its ascending support level. Following the rejection by its descending resistance level, as marked by the green rectangle, the Force Index continues to detach from its horizontal resistance level. Bears remain in complete control over the USD/INR with this technical indicator below the 0 center-line.

Rajiv Kumar, the Vice Chairman of think tank Niti Aayog, guarantees the Indian economy will reach pre-COVID-19 levels by the end of the fiscal year 2021-2022. He believes GDP will drop by less than 8.0% for the current fiscal year. The breakdown in the USD/INR through its short-term resistance zone between 73.670 and 73.899, as marked by the red rectangle, remains supported by its descending Fibonacci Retracement Fan sequence.

Morgan Stanley joins the bullish chorus and predicts that India, together with China, Indonesia and Singapore, will enjoy an accelerated GDP expansion starting in 2021. It labeled 2021 the start of a goldilocks period for many Southeast Asian economies. The USD/INR can drop into its adjusted support zone between 73.101 and 73.309, as identified by the grey rectangle, and extend into its next one between 71.409 and 71.710.

USD/INR Technical Trading Set-Up - Breakdown Acceleration Scenario

Short Entry @ 73.600

Take Profit @ 71.600

Stop Loss @ 74.000

Downside Potential: 20,000 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 5.00

Should the Force Index jump above its ascending support level, serving as resistance to the USD/INR, a brief price spike could follow. It will present Forex traders with a secondary selling opportunity amid improving conditions for the Indian economy against a worsening outlook for the US. The upside potential remains reduced to its intra-day high of 74.445

USD/INR Technical Trading Set-Up - Reduced Reversal Scenario

Long Entry @ 74.150

Take Profit @ 74.400

Stop Loss @ 74.000

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67