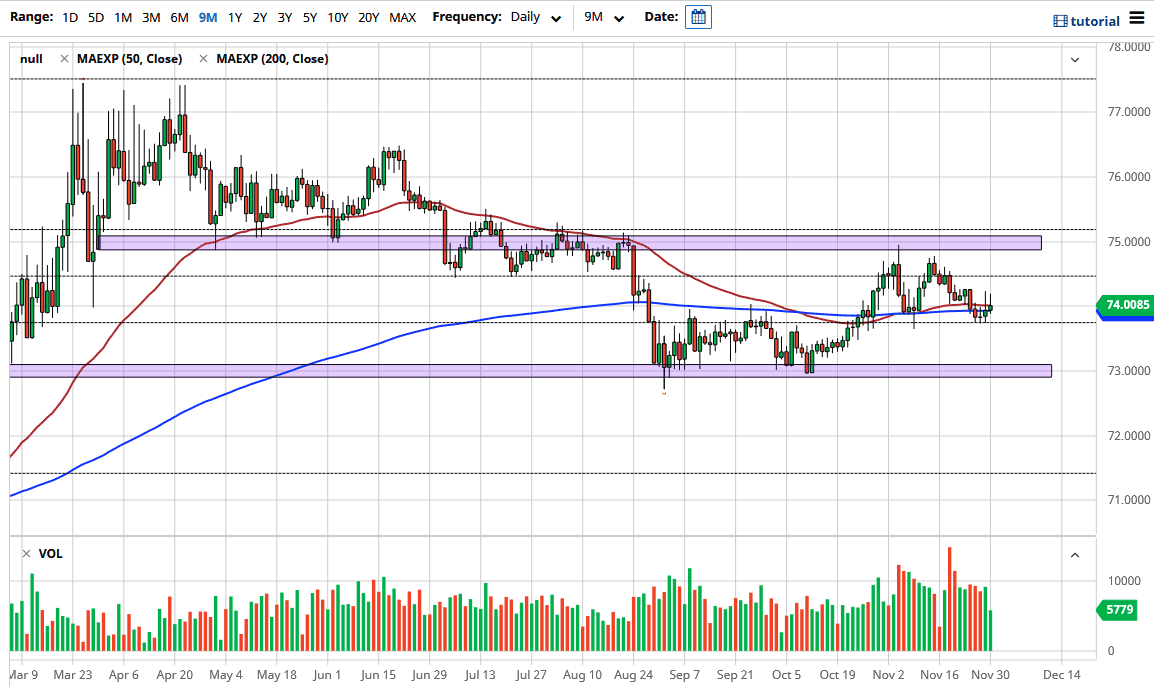

The US dollar did rally early during the trading session on Monday against the Indian rupee, but right around the ₹74 level we continue to see many issues. This is especially true once you get a bit to the upside, near the ₹74.20 level. This area has been resistance a couple of times now, and the fact that we formed a shooting star during the trading session just as we did during the previous one suggests that this is rapidly becoming a descending triangle. This means that on short-term rallies you will more than likely find sellers.

If you watched my analysis on the Indian rupee the other day, you know that I suggested that could be the case. We are currently relatively flat, but if we were to break down below the ₹73.80 level, that could open up mass selling down to the ₹73 handle. This is a market that does not move very quickly at times, but it certainly is relentless in its trending. Furthermore, if we were to break down below that ₹73 level, that would confirm a “double top”, or a so-called “M pattern”, if you like. We are likely to see a lot of negativity when it comes to this market, but we are still going to be somewhat range-bound between the ₹73 level on the bottom and the ₹75 level on the top.

This will come down to what happens with the US dollar. Remember, the US dollar is highly influenced by safety and the Federal Reserve. If we see the risk curve extend into emerging markets, then we could finally break down below that ₹73 handle and go much lower. In the meantime, I believe many traders out there are cautious to get overextended in emerging market currencies, simply because there are so many questions out there when it comes to how the global economy is going to perform, and how long it will take to beat back COVID-19. Right now, it is a little bit early to tell; but as you know, markets do tend to look into the future.