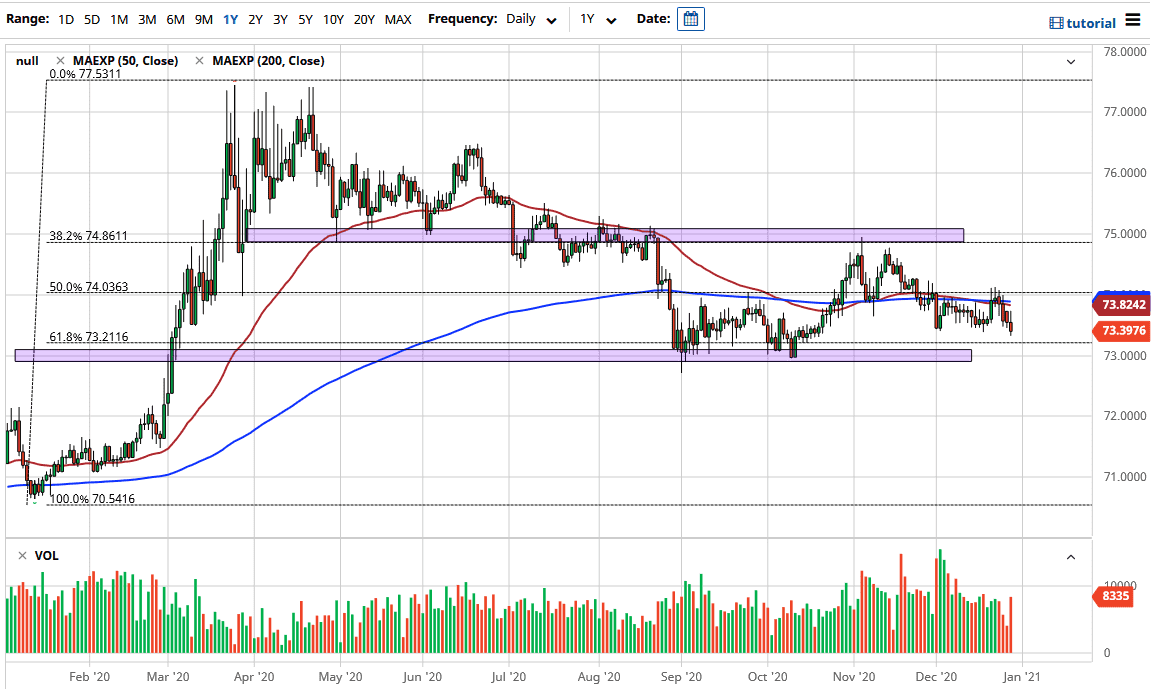

The US dollar initially tried to rally against the Indian rupee during the trading session on Tuesday. But it should be noted that we are trading very thin volumes right now, and that will be especially true when it comes to emerging market currencies such as the USD/INR currency pair. It is worth noting that the market has been trading in a relatively well-defined range, and we are approaching the bottom of it. That is the ₹73 level, so we will continue to be attracted to that level. If we can break down below the ₹73 level, that obviously would open up quite a bit of negativity, perhaps sending the US dollar down to ₹72.

The moving averages are essentially flat, as you can see the 50- and the 200-day EMA indicators are simply winding back and forth. The ₹74 level just above those moving averages has shown itself to be somewhat considered as “fair value” in this market, as it is in the middle of the range. To the upside, we would have the ₹75 level as significant resistance. We are clearly much more negative than positive right now, and if we were to break down below the ₹73 level, it would invalidate any thoughts of a “triple bottom.” The fact that we have bounced to the upside and then pulled back towards this area again does tell me that we are starting to see even more negativity.

With stimulus coming out of the United States, it does make sense that the US dollar would lose a bit of value, and the Indian rupee is considered to be a place where people will put capital to work if they feel like it is a “risk-on” type of scenario. As money flows away from the greenback, emerging market currencies in general should see a bit of a boost, with India being a particularly interesting area, as it is such high growth. Rallies at this point in time will more than likely continue to be faded, especially near the ₹74 level, as it has acted rather resistive over the last couple of weeks. I do think that we will eventually go much lower, but it may take a bit more time.