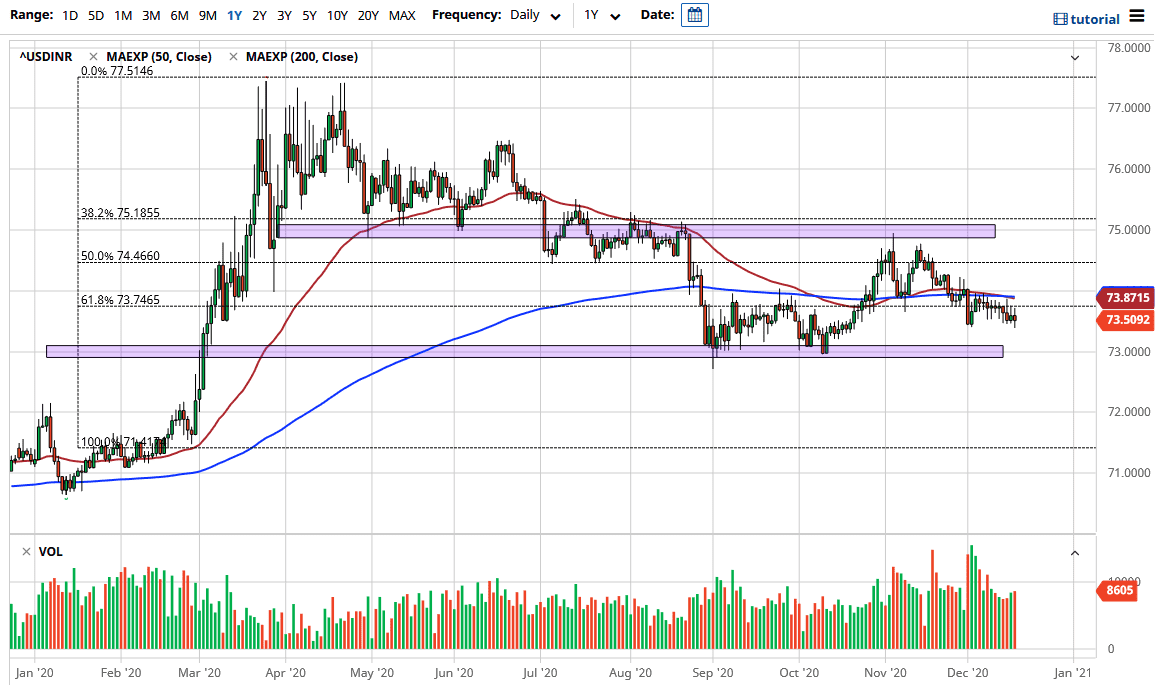

The US dollar has gone back and forth against the Indian rupee over the last week or so, as we hover around the ₹73.51 level. The 50 day EMA is winding back and forth with the 200 day EMA, and that is something worth paying attention to. Ultimately, I think the markets look extraordinarily flat, but I do recognize that there is a significant barrier underneath that should be important. The ₹73 level has already formed a bit of a “double bottom”, but all that did was send the rupee towards the 75 handle where it formed a bit of a “double top.”

With that being said, we are obviously in a very tight consolidation area, but it certainly looks as if the US dollar is on its back foot overall around the world. If that is going to continue to be the case, then it could extend itself to emerging market economies, such as India. After all, this is a great way to play emerging markets, trading the Rupee because of the interest rate differential and the importance that India plays on the world stage when it comes to emerging markets.

If we were to break down below the 73 Rupee level, then the market is likely to go looking towards the ₹72 region, possibly followed by ₹70, given enough time. I do not necessarily think that is going to happen easily, but it is a possibility if we get a bit of momentum to the downside. That being said, the US dollar is being sold off against almost everything, so it is probably only a matter of if and not necessarily when this happens. Rallies at this point should continue to be selling opportunities, especially near the moving averages. Because of this, I would look for signs of strength followed by bits and pieces of exhaustion to sell into. I have no interest in buying this pair, at least not until it clears the 75 level and also, I would have to see some type of major “risk off” type of scenario around the world to get overly excited about that. Ultimately, I remain bearish of this pair mainly due to the fact that stimulus is coming out the United States one would think that demand for goods should pick up from the subcontinent.