With the COVID-19 pandemic resulting in governments around the world spiking debt to support their domestic economies and thus fueling an unsustainable debt bubble, central banks slashed interest rates but also spiked their gold purchases. The Reserve Bank of India (RBI) purchased three times more gold in the first half of its fiscal year 2020-2021 than one year ago. The USD/INR gathered downside steam and can extend its breakdown sequence.

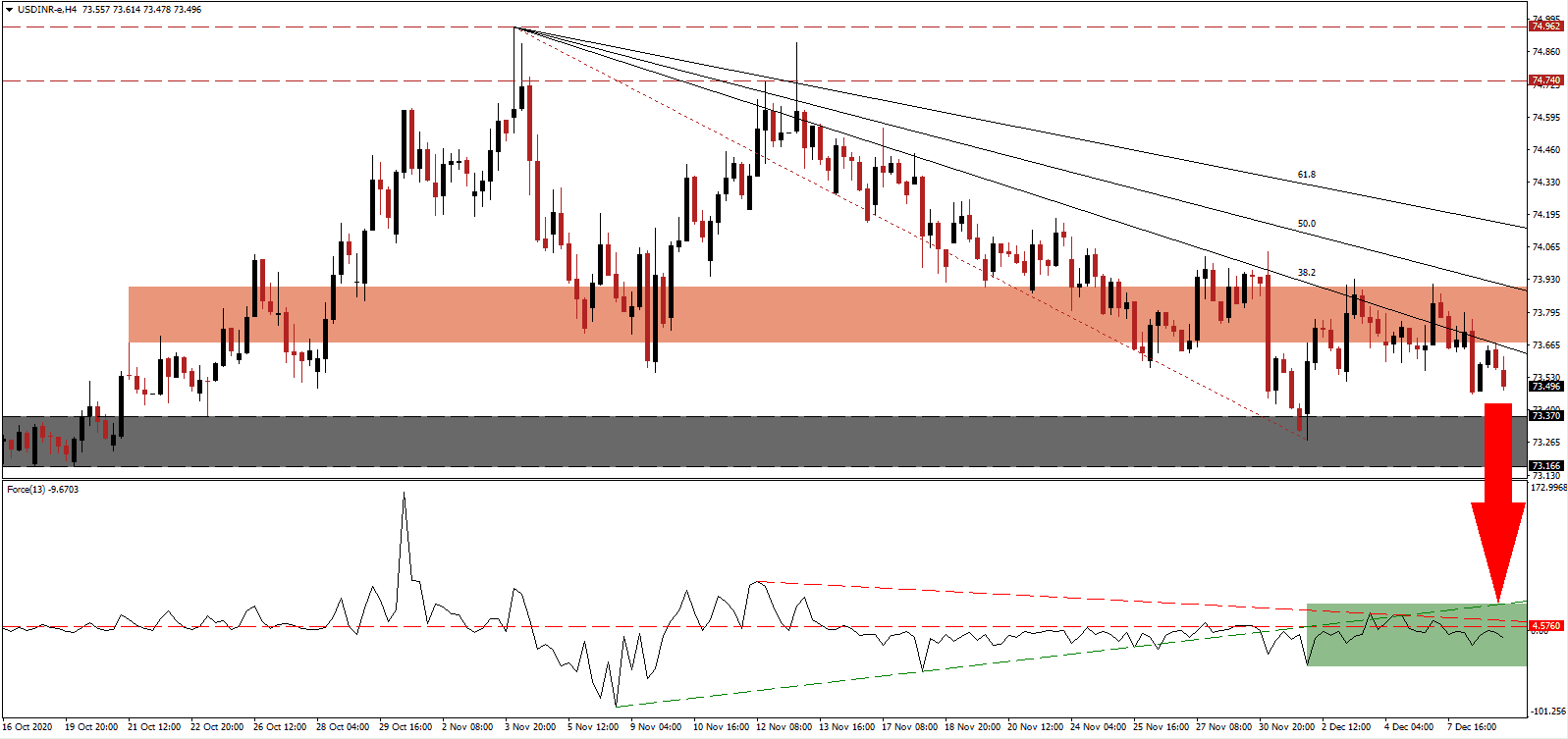

The Force Index, a next-generation technical indicator, continues to drift lower after being rejected by its ascending support level. It led to a move below its horizontal resistance level, as marked by the green rectangle, while the descending resistance level magnifies downside pressures. After this technical indicator moved below the 0 center-line, bears regained complete control over the USD/INR.

Fitch Ratings updated its GDP outlook for the Indian economy for the current fiscal year. It now forecasts a contraction of 9.4% versus a previously assessed drop of 10.5%. It echoes an upbeat mood from a growing number of institutions. The descending Fibonacci Retracement Fan can pressure the USD/INR farther to the downside after its breakdown below its short-term resistance zone between 73.670 and 73.899, as identified by the red rectangle.

Protests by Indian farmers to repeal three agricultural laws entered its fourteenth day. Union leaders met with three government ministers to discuss their demands. Agriculture remained a sole bright spot during the recession. Bearish pressures can take the USD/INR below its support zone between 73.101 and 73.309, as marked by the grey rectangle. The next one awaits between 71.409 and 71.710.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.500

Take Profit @ 71.500

Stop Loss @ 74.000

Downside Potential: 20,000 pips

Upside Risk: 5,000 pips

Risk/Reward Ratio: 4.00

A breakout in the Force Index above its ascending support level, serving as resistance, can take the USD/INR into a temporary reversal. The upside potential remains confined to its intra-day high of 74.445 amid a deteriorating outlook for the US dollar. Forex traders should take advantage of any advance with new short positions.

USD/INR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 74.150

Take Profit @ 74.400

Stop Loss @ 74.000

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67