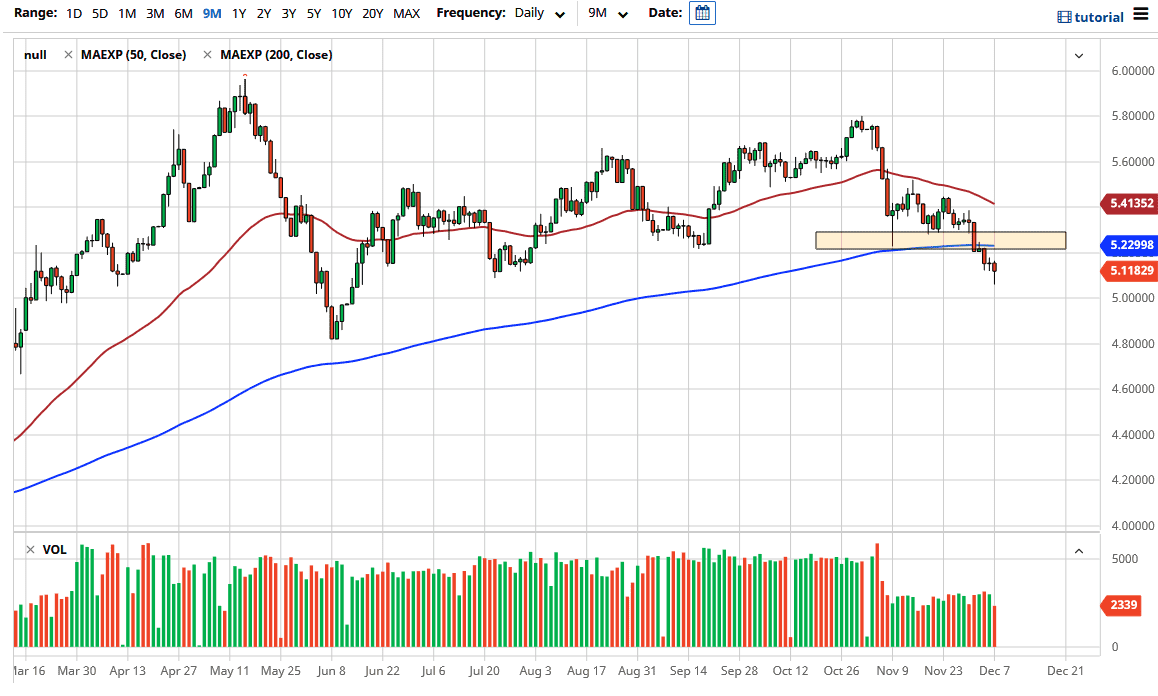

The US dollar fell again against the Brazilian real as we crossed the 5.10 threshold during the trading session on Monday. However, we recovered quite a bit and ended up forming a hammer. The hammer is a bullish sign, bu this is a short-term rally more than anything else. After all, the US dollar has been a bit oversold against other currencies, and it may have taken a while for that negativity to spread out to the emerging-market currencies such as the real.

The hammer that formed for the session is a bullish sign, but it is only a matter of time before the sellers return. Most notable would be the area around the 5.23 level, which is where the 200-day EMA sits. I suspect that somewhere in that area, on a bounce, there will be plenty of sellers jumping in to take advantage of a potential significant breakdown. This would be a “reflation trade” type of situation, which is what we have been seeing. That will continue going forward, but we may need a pullback in order to build up the necessary momentum to have traders jumping back towards emerging-market currencies.

I do not believe that we are going to be able to break above the 50-day EMA which currently sits at the 5.41 level, so I have no interest in trying to buy this market anytime soon. It is simply a matter of waiting for signs of exhaustion that you can take advantage of in order to go short. If we did break above the 5.41 level it would probably signify some type of shift in the overall attitude, which could have people looking to get involved for a bigger move, perhaps in a safety trade. But this certainly looks like a market that is ready to continue going lower after a pullback, perhaps reaching down towards the psychologically and structurally important 5.00 level. Keep in mind that Brazil had suffered greatly at the hands of the coronavirus, so those infection numbers in Brazil will continue to be a major influence as well.